EDITOR'S PICK

-

New Utah Law Takes Aim at Communist China’s Organ Harvesting Atrocities

-

Master Li Hongzhi: How Humankind Came to Be

‘The CCP is the greatest enemy of the Chinese nation’: Statements From the Tuidang Movement (March 2024)

Latest

- TikTok Surges in Vietnam Despite Increased Regulatory Pressures

- ‘Extraordinary artistry’: Shen Yun Delights Theatergoers in Sold-Out Lincoln Center Shows

- Civil War in Sudan Enters 2nd Year: 15,000 Dead, 8 Million Displaced

- ‘Very Positive Trends’: Number of Homicides Drops Significantly in the Big Apple

- Honoring Tradition: How Hong Kong’s ‘Noonday Gun’ Echoes Through History

FEATURED

-

Communist China Heads Down a Road of Isolation and Impoverishment

-

Chinese-American Artists Targeted in Planned NYT Piece That Would Misrepresent Falun Gong, Shen Yun Performing Arts

-

Shen Yun Artists Face Discrimination from Pro-CCP Official at US Customs Upon Return From European Tour

-

Tibetans in Exile – Raising Voices for a Distant Homeland

-

Toronto Marks 65th Tibetan Uprising Anniversary With Rally Against the CCP

-

New House Bill Targets TikTok

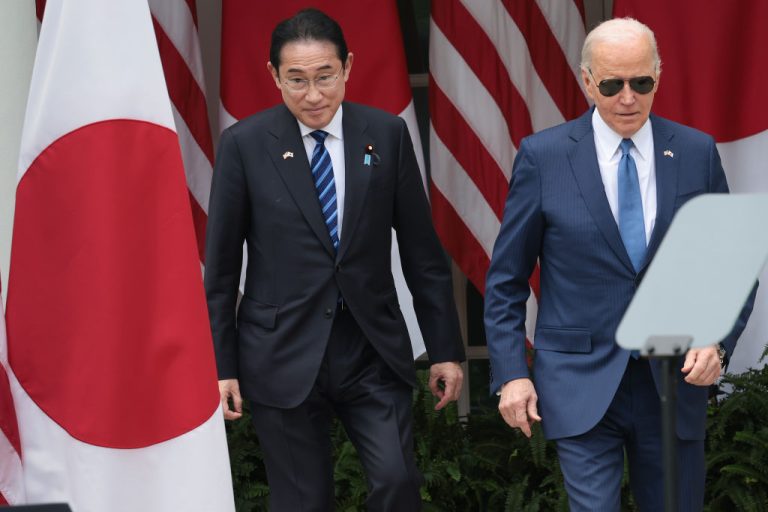

US Puts Pressure on China as Ukraine War Escalates

New York Republican lawmaker Sen. Mario Mattera, who represents the 2nd Senate District on Long Island, has tabled a bill intended to address what he calls the state’s squatting “epidemic” and that would give police the power to immediately evict squatters The legislation comes after several high-profile incidents involving squatters

-

Culinary Brilliance on Display at 87 Sussex: Jersey City’s New Dining Gem

Published with permission from LuxuryWeb Magazine Though new restaurants open frequently in

-

‘An extension of their souls’: Shen Yun Continues to Wow at Lincoln Center

NEW YORK, New York — After kicking off a highly anticipated 14-show

-

‘Beautiful!’: Shen Yun Wows Audiences in Multiple Sold Out Lincoln Center Performances

NEW YORK, New York — From April 3, to 14, Shen Yun,

- NY: MTA Demands NYC Marathon Pay 750k Congestion Pricing Toll for Using Verrazzano Bridge

- Production Delays, Disarray in Boeing Factory Prior to Door Plug Near Tragedy, WSJ Reports

- White House Directs NASA to Create Time Standard for the Moon

- Trillions of Cicadas to Swarm Several Eastern States This April

- US Officials Celebrate Shen Yun’s Return to Lincoln Center With Letters of Proclamation

- US Justice Department Sues Apple for Allegedly Engineering an Illegal Monopoly

- Trump’s Net Worth Surges by Billions Following Acquisition of His Social Media Platform Truth Social

- How Netflix’s ‘3 Body Problem’ Irks the CCP By Mirroring China’s Political Dynamics

- Intel Readies for $100 Billion Spending Spree Across Four US States

In the cutthroat world of China’s tech industry, non-compete clauses and corporate surveillance are increasingly binding tech workers to their employers — sometimes with severe personal consequences. As reported on April 3 by Japan's Nikkei Asia, an alarming narrative unfolds through the story of a young tech worker going by

-

5 Exemplary Women of Ancient China

In ancient China, women were educated and raised to uphold a range of traditional values, which could be

-

‘A new breath of life’: Shen Yun’s Opening Night at Lincoln Center Met With Resounding Acclaim

NEW YORK, New York — On April 3, Shen Yun kicked off its highly anticipated 14-show run at

Slovak nationalist government candidate Peter Pellegrini won the country's presidential election on April 6, cementing the influence of pro-Russia Prime Minister Robert Fico over the country. Fico, who took power for the fourth time last October, has turned the country's foreign policy to a more pro-Russian stance and initiated reforms

-

Chinese Students Recount Horrifying Experience During Concert Hall Shooting in Moscow

On March 23, several gunmen attacked the Crocus City Hall near Moscow;

-

Japan Reverses Course, Increases Interest Rates for First Time in 17 Years

Unlike most major economies, Japan has spent much of the 21st century

-

Davide Scabin Rumored to Bring Culinary Genius Back to Turin, Italy

Published with permission from LuxuryWeb Magazine During a major wine exposition in

- Hong Kong Passes Infamous ‘Article 23’ in Show of Growing Communist Hold

- A Global Guide to Sweet Wines: From Europe to North America

- Trafficked Cambodian Teen Saved Following Facebook Plea

- Argentinian Austerity Measures Show Mixed Results as Inflation Remains High

- US Seeks to Revive Dormant Shipyards With Help From South Korea and Japan

- Sherry: A Divine Nectar From Spain’s Sunny Shores

- Japan’s Daiwa House Planning US Factory for Prefab Homes

- Chinese-Philippine Maritime Collision Injures 4, Sparking Tensions in Contested South China Sea

- From Creamy to Cultured, Not All Butters Are Created Equal — Here Are Our Favorites

Do you suffer chronic symptoms that can’t be pinned down to any specific cause? Gastrointestinal disorders, headaches, hives, congestion, and itchy eyes can all be caused by histamine intolerance. Like gluten intolerance a couple decades ago, this condition is just gaining recognition and becoming a topic of study. Because it

-

‘Absolutely brilliant’: Theatergoers Marvel at Shen Yun Performance in New Jersey

NEW BRUNSWICK, New Jersey — On March 31, Shen Yun concluded a five-show run at the prestigious State Theater in New Jersey. Audience members reported being enthralled with the show’s gravity-defying acrobatics, vibrant colors, and dazzling displays of art and music. Established in 2006 and based in New York, Shen

NEW BRUNSWICK, New Jersey — On March 31, Shen Yun concluded a five-show run at the prestigious State Theater in New Jersey. Audience members reported being enthralled with the show’s gravity-defying acrobatics, vibrant colors, and dazzling displays of art and music. Established in 2006 and based in New York, Shen

-

A Modern Echo of Marie Antoinette: Corporate Indifference in Times of Economic Strain

Published with permission from LuxuryWeb Magazine In the realm of reincarnation, it's interesting to ponder about who might

-

China Hands Life Sentence to Former Soccer Chief Amid Sweeping Anti-Corruption Campaign

On March 26, a court in China’s central province of Hubei sentenced several high-ranking soccer officials, including Chen

Sprightly and tenacious, feverfew is a member of the world’s largest and most diverse plant family — Asteraceae. Native to Asia and Europe, feverfew was first introduced to the United States in the 19th century. It is now commonly grown as a perennial in hardiness zones 5-10. Its small, prolific

-

The Power of Optimism – The Key to Longevity and Health

Life is hard, and staying positive is even harder. There are those who, despite sporting the scars of

-

Food Allergies – Why We Get Them, and How to Alleviate Them Naturally

Food allergies are an increasingly common dietary fret that can make dining out a risky affair. They occur

Colorful, artistic and sometimes sweet, decorated Easter eggs are almost a worldwide tradition. These charming gems make their appearance at the beginning of each spring, not only marking a time of rebirth in nature, but also reminding the faithful of Jesus' rise from the tomb.Traditionally, decorated Easter eggs have been

-

Communist China Ramps Up Efforts to Intimidate Shen Yun With Sabotage, Unhinged Threats of Violence

In the most recent manifestation of efforts to sabotage the growing cultural force that is Shen Yun, the

-

The Joy of Knitting – And Why It’s Time to Learn a Craft

Michèle Bowland learned to knit under the patient guidance of her nana Maureen. As a six-year-old, petting yarn,