EDITOR'S PICK

-

‘The CCP is the greatest enemy of the Chinese nation’: Statements From the Tuidang Movement (March 2024)

-

Master Li Hongzhi: How Humankind Came to Be

China’s Overseas Product Dumping: Addressing Unfair Competition Caused by Systemic Differences

Faced with unfair competition brought about by systemic differences, countries around the world are right to impose tariffs and other barriers on Communist China

Latest

- Caribbean Treasure: Discovering the Rich Heritage of Ron Barceló Imperial Rum

- Mandarin Pop Song Lyrics Shift From Romance to Calls for Freedom, New Research Suggests

- Charges Laid One Year After Historic Canadian Gold Heist

- Hundreds of Migrants Descend on New York City Hall Pleading for Work Permits, Green Cards

- A Journey Through Morocco: How to Master the Region’s Delicious Culinary Traditions

FEATURED

-

US Puts Pressure on China as Ukraine War Escalates

-

Communist China Heads Down a Road of Isolation and Impoverishment

-

Chinese-American Artists Targeted in Planned NYT Piece That Would Misrepresent Falun Gong, Shen Yun Performing Arts

-

Shen Yun Artists Face Discrimination from Pro-CCP Official at US Customs Upon Return From European Tour

-

Tibetans in Exile – Raising Voices for a Distant Homeland

-

Toronto Marks 65th Tibetan Uprising Anniversary With Rally Against the CCP

Biden Proposes Tripling Tariffs on Chinese Steel, Aluminum to Counter Beijing’s Product Dumping

On April 16, U.S. Treasury Secretary Janet Yellen said Iran's attack on Israel last weekend and its financing of militant groups in Gaza, Lebanon, Yemen and Iraq threatened stability in the Middle East and could result in economic spillovers. At a news conference, reading from prepared remarks, Yellen called Iran’s

-

‘Extraordinary artistry’: Shen Yun Delights Theatergoers in Sold-Out Lincoln Center Shows

NEW YORK, New York — After kicking off a highly anticipated 14-show

-

‘Very Positive Trends’: Number of Homicides Drops Significantly in the Big Apple

According to numbers compiled by AH Datalytics, the number of nonnegligent manslaughters,

-

Controversial Geoengineering Experiment Launched Quietly in San Francisco to Avoid Public Backlash

On Tuesday, April 2, researchers with the University of Washington quietly conducted

- NY: Long Island Sen. Mario Mattera Tables Bill Addressing Squatting ‘Epidemic’

- Culinary Brilliance on Display at 87 Sussex: Jersey City’s New Dining Gem

- ‘An extension of their souls’: Shen Yun Continues to Wow at Lincoln Center

- ‘Beautiful!’: Shen Yun Wows Audiences in Multiple Sold Out Lincoln Center Performances

- NY: MTA Demands NYC Marathon Pay 750k Congestion Pricing Toll for Using Verrazzano Bridge

- Production Delays, Disarray in Boeing Factory Prior to Door Plug Near Tragedy, WSJ Reports

- White House Directs NASA to Create Time Standard for the Moon

- Trillions of Cicadas to Swarm Several Eastern States This April

- US Officials Celebrate Shen Yun’s Return to Lincoln Center With Letters of Proclamation

Published with permission from LuxuryWeb Magazine Every day at noon in Hong Kong, a distinct ceremony unfolds — a ship's bell rings followed by the firing of a cannon, its sound reverberating across Causeway Bay. The Noonday Gun has become a cherished ritual, deeply embedded in the city's rich history.

-

How Noncompete Agreements and Corporate Surveillance Are Crushing China’s Tech Workers

In the cutthroat world of China’s tech industry, non-compete clauses and corporate surveillance are increasingly binding tech workers

-

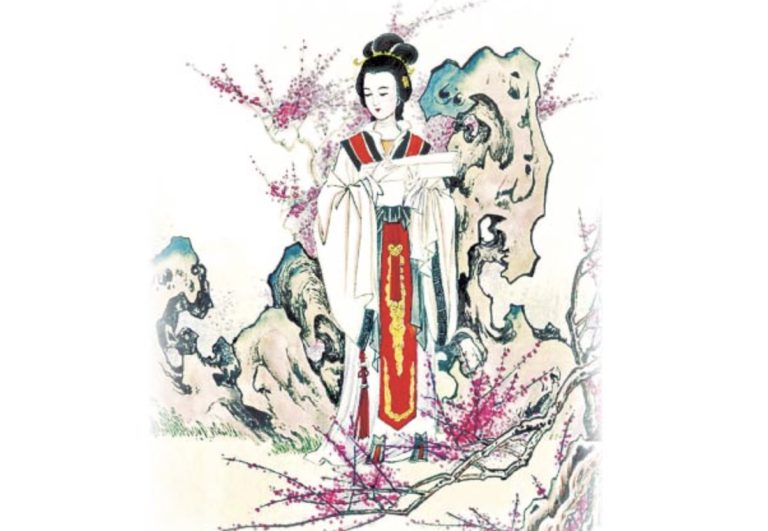

5 Exemplary Women of Ancient China

In ancient China, women were educated and raised to uphold a range of traditional values, which could be

The civil war in Sudan has been raging for over a year now, having begun on April 15, 2023. Since then, the regions of Darfur, Kordofan, Gezira, and Khartoum — the last being the northeastern African country's capital — have been the sites of fighting, which since the start of

-

Peter Pellegrini Wins Slovak Presidential Election, Beating Pro-Western Opposition

Slovak nationalist government candidate Peter Pellegrini won the country's presidential election on

-

Chinese Students Recount Horrifying Experience During Concert Hall Shooting in Moscow

On March 23, several gunmen attacked the Crocus City Hall near Moscow;

-

Japan Reverses Course, Increases Interest Rates for First Time in 17 Years

Unlike most major economies, Japan has spent much of the 21st century

- Davide Scabin Rumored to Bring Culinary Genius Back to Turin, Italy

- Hong Kong Passes Infamous ‘Article 23’ in Show of Growing Communist Hold

- A Global Guide to Sweet Wines: From Europe to North America

- Trafficked Cambodian Teen Saved Following Facebook Plea

- Argentinian Austerity Measures Show Mixed Results as Inflation Remains High

- US Seeks to Revive Dormant Shipyards With Help From South Korea and Japan

- Sherry: A Divine Nectar From Spain’s Sunny Shores

- Japan’s Daiwa House Planning US Factory for Prefab Homes

- Chinese-Philippine Maritime Collision Injures 4, Sparking Tensions in Contested South China Sea

In response to a rare 4.8 magnitude earthquake, followed by multiple, smaller aftershocks, many East Coast natives are grappling with earthquake awareness for the first time. Epicentered near Gladstone, New Jersey, slight tremors were felt as far south as northern Virginia and north to the border of New Hampshire. No

-

‘A new breath of life’: Shen Yun’s Opening Night at Lincoln Center Met With Resounding Acclaim

NEW YORK, New York — On April 3, Shen Yun kicked off its highly anticipated 14-show run at the city’s prestigious Lincoln Center. Nearly all tickers were sold out, and theatergoers lucky enough to secure seats raved about the show's vibrant dancing, choreography, gravity-defying acrobatics, and immersive digital backdrops, among

NEW YORK, New York — On April 3, Shen Yun kicked off its highly anticipated 14-show run at the city’s prestigious Lincoln Center. Nearly all tickers were sold out, and theatergoers lucky enough to secure seats raved about the show's vibrant dancing, choreography, gravity-defying acrobatics, and immersive digital backdrops, among

-

A Holistic Approach to Histamine Intolerance

Do you suffer chronic symptoms that can’t be pinned down to any specific cause? Gastrointestinal disorders, headaches, hives,

-

‘Absolutely brilliant’: Theatergoers Marvel at Shen Yun Performance in New Jersey

NEW BRUNSWICK, New Jersey — On March 31, Shen Yun concluded a five-show run at the prestigious State

Sprightly and tenacious, feverfew is a member of the world’s largest and most diverse plant family — Asteraceae. Native to Asia and Europe, feverfew was first introduced to the United States in the 19th century. It is now commonly grown as a perennial in hardiness zones 5-10. Its small, prolific

-

The Power of Optimism – The Key to Longevity and Health

Life is hard, and staying positive is even harder. There are those who, despite sporting the scars of

-

Food Allergies – Why We Get Them, and How to Alleviate Them Naturally

Food allergies are an increasingly common dietary fret that can make dining out a risky affair. They occur

Colorful, artistic and sometimes sweet, decorated Easter eggs are almost a worldwide tradition. These charming gems make their appearance at the beginning of each spring, not only marking a time of rebirth in nature, but also reminding the faithful of Jesus' rise from the tomb.Traditionally, decorated Easter eggs have been

-

Communist China Ramps Up Efforts to Intimidate Shen Yun With Sabotage, Unhinged Threats of Violence

In the most recent manifestation of efforts to sabotage the growing cultural force that is Shen Yun, the

-

The Joy of Knitting – And Why It’s Time to Learn a Craft

Michèle Bowland learned to knit under the patient guidance of her nana Maureen. As a six-year-old, petting yarn,