According to the Digital Guardian, Americans lost more than 70 percent more to fraud in 2021 than the year prior, representing approximately $5.8 billion in losses. Scammers are relying on both new and tried-and-true scams to bilk Americans out of their hard-earned money.

Fraud surged during the COVID-19 pandemic. In 2019 fraud accounted for $1.8 billion in losses, a number that spiked to $5.8 billion by 2021.

Phone scams are some of the more popular scams currently being operated that rely on one’s smartphone’s capabilities to get in touch with potential victims.

Phone scammers will use robocalls, texts, impersonators, special applications and even QR codes to gather information on a target or to completely compromise someone’s device.

Robocalls are becoming more and more sophisticated with natural-sounding voices that offer everything from vehicle warranties to vacations and even issue threats of legal proceedings to capture a target’s attention, but two strategies have emerged over recent years that users should be aware of.

SIM swapping and one-time password bots

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

Two popular phone scams to be aware of in 2023 include SIM swapping and one-time password (OTP) bots.

SIM Swapping occurs when a scammer steals your phone number and assigns it to a new SIM card. The scammer then uses your information to log into accounts associated with the number. This allows the scammer to bypass security features, like one-time verification codes, that allows the scammer to reset passwords for private accounts using a code or link sent to the phone.

To protect yourself from this scam one can try contacting their mobile phone provider and ask to add extra security or implement a temporary freeze to number porting. Users should also check to see if their provider offers non-SMS multi factor authentication, where you need to provide at least two pieces of proof of identity.

One-time password (OTP) bots are an alternative to SIM swapping. OTP bots trick people into sharing authentication codes that are sent to them via text message or email.

Bots may send a robocall to the device or a text appearing as a legitimate company.

One popular scam that utilizes OTP bots sends a robocall to a device asking for the user to authorize a charge and instructs the user to enter a code. What is really happening is the bot is trying to log in to your account, triggering the system to send you a code, which is then communicated, by the victim, to the scammer and used to log into the target account.

Zelle and crypto scams

Zelle, a peer-to-peer payment app, is being used by scammers to steal people’s money. Victims receive an email, text or call from someone pretending to work for the victim’s financial institution’s fraud department. The scammer will claim that someone is attempting to compromise the victim’s account and will offer to help “fix” the issue. They will instruct the target to send money to themselves when in reality the money will actually go to the scammers account.

Cryptocurrency scams are prevalent and can range in complexity from very simple to extremely complex with many scammers exploiting people’s fear of missing out on an opportunity to profit.

Be aware of crypto offers that promise high returns over short periods of time; if it sounds too good to be true, it probably is.

Some scammers will even impersonate celebrities to lure victims into sending them money or to “invest” in the latest token which quickly plummets in value.

“Rug pulls” are another popular way scammers trick victims into parting with their money.

A “rug pull” occurs when a new token is created and scammers use social media to fabricate hype over the new coin. Excited investors pour money into the token only to have insiders sell their tokens at a high amount which causes the token’s value to bottom out. The scammers walk away with the investors money while people who “invested” are left with a worthless cryptocurrency.

READ MORE:

- Chinese New Year Event Attracts DC Area Public Figures, VIPs

- The ‘Most Fatherless Generation’: California Pastor Describes the Consequences of a Growing Crisis

- Deconstructing the US Gas Stove Controversy

Romance and online purchase scams

Romance scams are confidence tricks. Scammers will feign romantic intentions, gain the target’s affection, and then, using goodwill, convince the target to send them money or personal information that they then exploit.

To protect yourself from such scams, the Federal Bureau of Investigation (FBI) recommends that people be careful what they post online. Scammers use details shared on social media and dating sites to better understand and target you.

Reverse image searches are a good way to determine if the person you are engaging with is being forthright.

A major red flag is if the person you are engaging with attempts to isolate you from friends and family or asks for money and personal information. Be suspicious if they ask to meet in person only to come up with excuses as to why they are unable to attend.

According to the Better Business Bureau, online purchase scams posed the greatest risks to consumers in 2022.

The most basic online shopping scam is when purchasers hand over money for a product or service that is never delivered.

Puppy scams are the most common. People looking for a certain breed of dog hand over thousands of dollars only to later find out that the supplier wasn’t legit.

To protect yourself from this type of scam, never find a seller through online marketplaces like Craigslist, Facebook or Kijiji, they are likely illegitimate vendors.

If you are unable to get in touch with a vendor, who requires a deposit, it is likely a scam and if the puppy is available immediately that is also a red flag. Responsible, legitimate breeders often have a waitlist and do not breed every year.

If the price seems too good to be true, it is and if the vendor says the animal needs to be shipped that is another red flag. Reputable breeders do not ship puppies by plane.

Doing a quick reverse image search of the picture of a pet may reveal that the vendor is a scammer and if payment is requested in gift cards it’s a sure sign that you are engaging with a scammer.

How to protect yourself

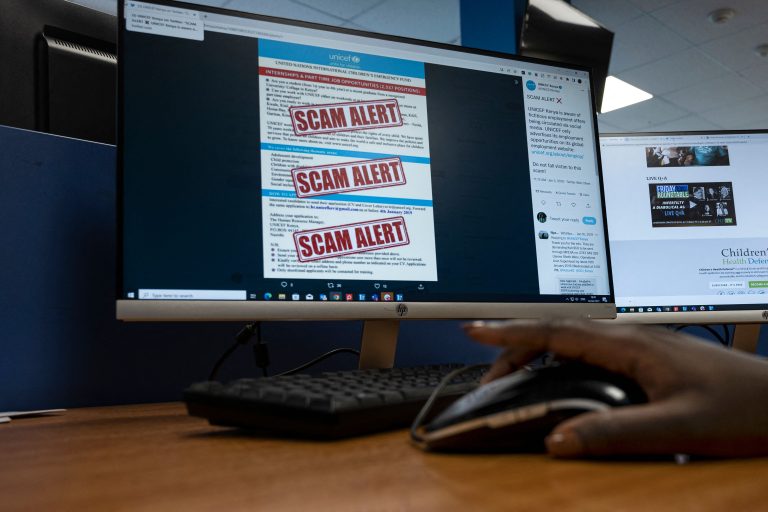

It’s best to remain skeptical if someone you don’t know contacts you for any reason. Scammers can spoof calls and emails to look like a legitimate business and can appear to be coming from any number of legit sources including government agencies, charities, and banks.

Enable multifactor authentication whenever you can and research companies before making a purchase, donation or investment.

Your smartphone is the primary way scammers will try to approach you. Don’t respond to any spam calls, or click any links embedded in text messages or emails unless you are confident you know the source and if in doubt, call the organization contacting you directly to confirm they are legit.

Scammers often ask for payment or ask you to refund or forward a payment, if someone asks for an upfront payment you should be suspicious.

Look for suspicious payment requirements like wire transfers or money orders. If they ask to be paid in gift cards, it’s a scam.