The U.S. national debt is calculated to almost double from $22.28 trillion to $43.48 trillion by 2033, according to official forecasts by the Congressional Budget Office (CBO).

Additionally, modeling anticipates that the interest rate on the national debt is set to increase by more than 50 percent.

The report, titled The Budget and Economic Outlook: 2023 to 2033, directly states, “After all the government’s borrowing needs are accounted for, debt held by the public rises from $24.3 trillion at the end of 2022 to $46.4 trillion at the end of 2033 in CBO’s baseline projections.”

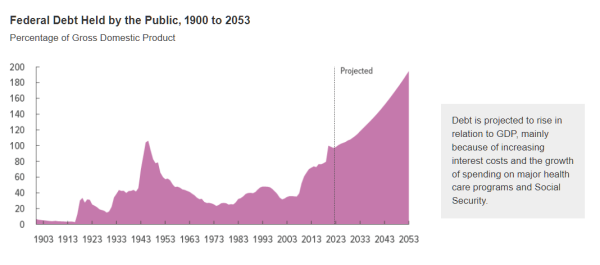

“As a percentage of GDP, that debt is projected to stand at 118 percent at the end of 2033—about 21 percentage points higher than it was at the end of 2022 and about two and a half times its average over the past 50 years,” the CBO adds.

An additional chart included in the graph that extrapolates two further decades ahead shows that the debt as a percentage of GDP is anticipated to reach 200 percent by 2053.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

The document explains that the figure is based on the amount the U.S. Treasury borrows from the public, and is heavily tied to “additional borrowing” that the CBO states “stems from the need to finance federal loan programs.”

MORE ON FEDERAL SPENDING

- $2.25 Trillion American Jobs Plan Infrastructure Bill ‘Really, is the Green New Deal’: Washington Post

- Biden Unveils Pandemic Spending Package Featuring $15 Minimum Wage, Expanded Unemployment

- Maine’s Jared Golden Only Democrat Dissent as House Passes Final $1.9 Trillion American Rescue Plan

Although “the subsidy costs for those programs are included in the projected deficit for each year from 2024 to 2033,” the CBO notes that, “The cash disbursements needed to finance those programs each year—for example, in the case of direct loans, the funds lent to borrowers minus the repayments of principal and payments of interest and other fees—are greater than the net subsidy costs.”

“The Treasury needs to borrow funds each year to make up that difference,” the Office notes.

In its 2023 outlook, the CBO calculated that the federal government would, between 2024 and 2033, need to spend:

- $18.8 trillion on social security

- $22.7 trillion on healthcare programs

- $4 trillion on income assistance programs such as food stamps and unemployment

- $2.4 trillion on federal civilian and military retirement packages, and

- $2.9 trillion on veterans’ programs.

Additionally, the CBO anticipates that federal “discretionary spending” earmarked for national defense will increase from $816 billion per year in 2022 to $1.15 trillion by 2023.

Discretionary spending earmarked for non-defense is forecasted to increase from $969 billion annually in 2022 to $1.21 trillion by 2023.

The CBO also shows that the average interest rate paid on debt held by the public is set to balloon by more than 50 percent in the next decade from 2.1 percent to 3.2 percent.

A March of 2020 CBO report titled Federal Debt: A Primer explains that the government is well aware that spending is out of control.

“From the end of 2008 to 2019, the amount of federal debt held by the public nearly tripled,” the primer states.

It adds, “During the past decade, the federal government’s debt increased at a faster rate than at any time since the end of World War II, outstripping economic growth over that period. At the end of 2019, federal debt was higher than at any other time since just after the war.”

In the 2020 report, the CBO had already anticipated that the debt would reach $31.4 billion, amounting to 98 percent of GDP, by 2030.

At the time, the Office warned, “Such high and rising debt could significantly affect the U.S. economy and the federal budget.”

In a third document titled Federal Net Interest Costs: A Primer dated December of 2020, the CBO explained, “In fiscal year 2020, the government’s net outlays for interest totaled $345 billion, equal to 1.6 percent of gross domestic product (GDP) and accounting for 5.3 percent of total spending.”

“The federal government’s interest payments depend largely on interest rates and the amount of debt held by the public. Other factors, such as the rate of inflation and the maturity structure of outstanding securities, also affect interest costs,” the office added.

The CBO continues, “Interest rates are determined by market forces, such as the supply and demand for Treasury securities, and the policies of the Federal Reserve.”

Yet when the document was written, the Fed had just slashed rates from 1.5 percent to 0.25 percent as part of the overarching pandemic economic stimulus and bailout measures.

Rates stayed at historic lows until the central bank began hiking in March 2022. Today, the Federal Funds Effective Rate sits at 4.33 percent, and is anticipated to continue to rise.

The primer stated at the time: “In the Congressional Budget Office’s most recent projections, which incorporate the assumption that current laws governing revenues and spending generally remain the same, the cumulative deficit from 2021 through 2030 totals nearly $13 trillion.”

The CBO continued, “Borrowing to finance that deficit—at a time when interest rates are expected to rise—would cause net interest outlays to more than double over the next 10 years, from an estimated $290 billion in 2021 to $664 billion in 2030.”

“For the majority of those 10 years in CBO’s forecast, interest rates remain historically low despite the rise in public debt,” was added as a caveat, however.