Inflation is hitting record levels and Americans are spending more of their earnings on their daily needs. According to a new analysis from the Penn Wharton Budget Model (PWBM), this year’s inflation will have made average U.S. households spend $3,500 more to achieve the same level of consumption of goods and services as in 2019 and 2020. PWBM is a nonpartisan group at Wharton School in the University of Pennsylvania.

“We estimate that lower-income households spend more of their budget on goods and services that have been more impacted by inflation. Lower-income households will have to spend about 7 percent more while higher-income households will have to spend about 6 percent more,” the report states.

Lower-income households spend more on energy that has seen wild swings this year. As a result, they are disproportionately hurt by inflation. In contrast, wealthy people tend to spend more on services that have been the least impacted by inflation. According to PWBM’s calculations based on spending data from 2020, the bottom 20 percent of earners might see their consumption expenditure rise by 6.8 percent per household. The top five percent would see a 6.1 percent increase in expenses while the middle-income group experiences a rise of 6.8 percent.

The Penn Wharton Budget Model analysis comes close on the heels of a Gallup survey which found that 45 percent of American households are facing some kind of difficulty due to the price hikes.

Ten percent said that inflation has affected their standard of living; 35 percent stated that the hardship due to inflation was “moderate.”

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

Seventy-one percent of households making $40,000 and below per year blamed price increases for causing financial hardship. Among middle-income households, this number was at 47 percent; for upper-income households, it was at 29 percent.

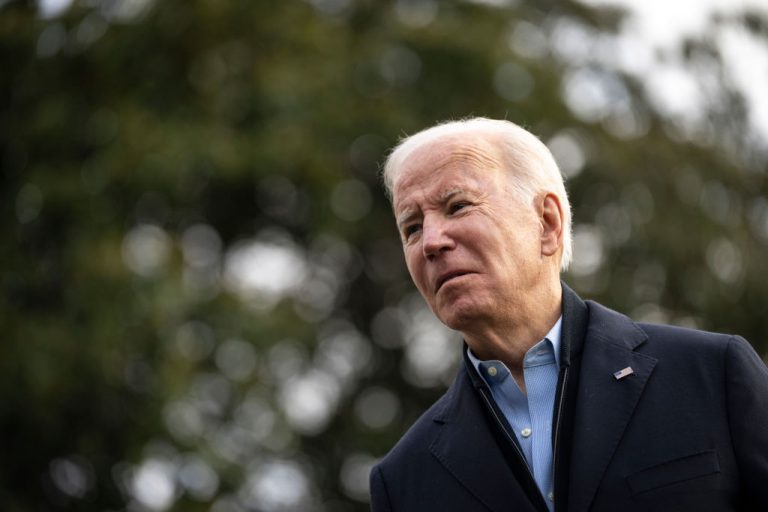

Joe Biden has constantly sought to dismiss concerns regarding inflation. On Dec. 10, the president told reporters that he believes it is the “peak of the crisis.” However, many economic experts believe that inflation will persist at high levels next year.

According to a Dec. 16 survey by the National Association for Business Economics (NABE), its panel of 48 business economists predicted consumer prices to surge by 6 percent in the final quarter of this year.

“The core consumer price index, which excludes food and energy costs, is now expected to rise 6.0% from the fourth quarter of 2020 to the fourth quarter of 2021, compared to the September forecast of a 5.1% increase over the same period. Nearly three-fourths of respondents—71%—anticipate that the Federal Reserve’s preferred gauge of inflation, the change in the core PCE price index, will not cool down to or below the Fed’s target of 2% year-over-year until the second half of 2023 or later,” NABE Vice President Julia Coronado said in a statement.

Meanwhile, some are worried about Biden’s multi-trillion dollar Build Back Better’s financial impact on average Americans. In an interview with Fox News, Republican Senator John Kennedy warned that the $5-trillion Build Back Better, which is made up of $2 trillion in new taxes and $3 trillion in borrowing, “will cause a massive increase in inflation.” He believes the Biden administration is “playing with fire.”

“It’s going to require our Federal Reserve to raise interest rates much, much sooner than we thought… I’m really worried about the impact of that on our economy. We don’t have a choice. We have got to control inflation because it’s a tax on all of us. But, on the other hand, I don’t want an interest rate class to throw us into a recession,” Kennedy said.