News analysis

The People’s Republic of China (PRC) has played a critical role in supporting Iran, buying Iranian oil and other materials despite U.S. sanctions on the Islamic regime. The Sino-Iranian Agreement, signed March 26 last year, deepens this relationship and advances Beijing’s financial agenda as it places the digital yuan at the forefront.

A review of the U.S. sanctions against Iran shows that the financial penalties are the most powerful. The U.S. began imposing economic sanctions on Iran in 2005, cutting it off CHIPS (New York Clearing House Interbank Payment System) in 2008 so that it could not receive U.S. dollars, and cutting it off SWIFT in 2012 so that Iran could not participate in international financial transactions at all.

China, however, is Iran’s largest trading partner and was one of its largest oil buyers before then-U.S. President Donald Trump reimposed sanctions on Iran in 2018. Although Beijing has officially stopped importing oil from Iran, analysts say Iranian crude is being disguised as crude from other countries and continues to be shipped to China.

Sino-Iranian talks

Chinese Foreign Minister Wang Yi held talks with Iranian Foreign Minister Hossein Amirabdollahian in Wuxi, Jiangsu Province on January 14, and the two sides announced the launch of a comprehensive cooperation program between the two countries, according to a news release on the Chinese Foreign Ministry website on Jan. 15.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

China became a vital economic lifeline for Iran after the Trump administration withdrew the U.S. from the multilateral nuclear accord in 2018 and reimposed sanctions on Tehran.

“However, what remains unclear is how much China and Russia are prepared to risk for Iran while U.S. sanctions remain in place.” reported Wall Street Journal.

A State Department spokesperson, while declining to comment on Iran’s barter deals, said that the U.S. is enforcing its sanctions on Iran. “We will of course address any effort at sanctions evasion,” the spokesperson said, according to a Wall Street Journal report on Jan. 14, 2022.

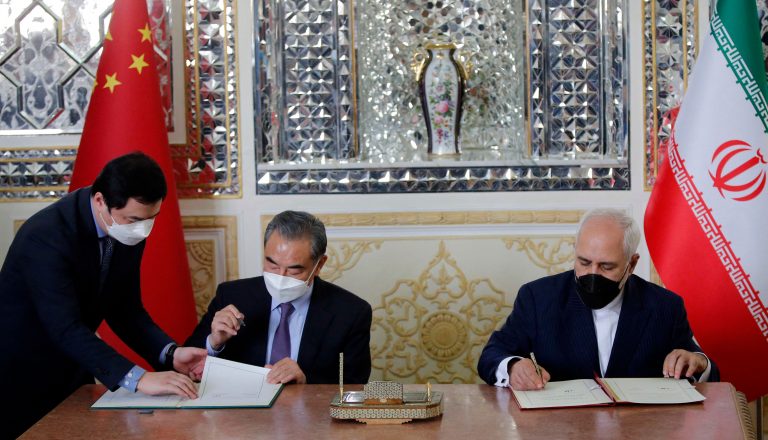

On March 27 last year, during his visit to Iran, Wang Yi and Iranian Foreign Minister Mohammad Javad Zarif signed the “Iran–China 25-year Cooperation Program”, which includes Iran in the “Belt and Road” Initiative.

China agreed to invest $400 billion in Iran over a 25-year period in exchange for a steady supply of oil to fuel its growing economy, according to the New York Times.

In return for investments, China would receive steady supplies of Iranian oil, Iran’s semi-official Tasnim news agency said Saturday, adding that the two countries also agreed to establish an Iranian-Chinese bank. Such a bank could help Tehran evade U.S. sanctions that have effectively barred it from global banking systems, according to a March 27, 2021 Wall Street Journal report.

It is reported that the agreement includes three major aspects: China and Iran’s oil and trade settlement in yuan and digital yuan; China and Iran will also cooperate in military matters. The agreement also proposes joint military exercises, weapons development, and intelligence sharing. Meanwhile, China’s Beidou satellite system will support Iran’s missile program.

The digital yuan in the “Iran–China 25-year Cooperation Program” has also caused international concerns.

Since 2014, the Central Bank of China (CBC) has been conducting research on digital currency and is currently in the pilot application period. The digital yuan has been piloted in many cities in China, and the application scenarios gradually cover various fields such as daily payment, catering, transportation, shopping, and administrative services.

On Jan. 18, the CBC held a press conference at which Zou Lan, director of the Department of Financial Markets of the CBC, introduced the digital yuan pilot, saying that as of December 31, 2021, digital yuan pilot occasions had exceeded 8,085,100, with an accumulated total of 261 million personal wallets opened and a transaction amount of 87.565 billion yuan.

Promoting the digital currency

Mu Changchun, director of the Institute of Digital Currency of CBC, said recently that CBC and the Hong Kong Monetary Authority (HKMA) have started the second phase of digital yuan to further enhance the efficiency of cross-border payments.

The CBC has previously released its first white paper on the digital renminbi, saying that it is ready for cross-border use and will study its applicability in cross-border areas.

On the other hand, the interim findings of the “Multi-Central Bank Digital Currency Bridge” (mBridge) project, jointly conducted by the Institute of Digital Currency of the Bank of China, the HKMA, the Bank for International Settlements, the Bank of Thailand, and the Central Bank of the United Arab Emirates, show that the project has the potential to accelerate cross-border payments and save costs.

In addition, Beijing authorities are preparing to promote the digital yuan at the upcoming Winter Olympics in Beijing, a move intended to cut into the U.S. dollar-dominated global financial system and enhance Beijing’s strategic competitiveness globally.

The UK-based Financial Times previously reported, citing sources familiar with the matter, that Beijing authorities have pressured a number of U.S. companies to install a system that allows consumers to pay for their products with digital yuan before the opening of the Olympics, including major U.S. companies such as McDonald’s, Nike, and Visa.