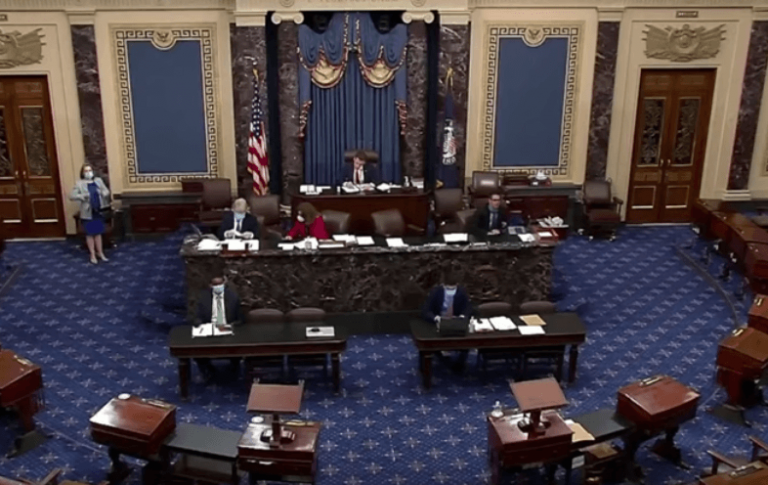

Mainland Chinese companies must adhere to U.S. national financial regulations, or face delisting on America’s stock exchanges, according to legislation passed by the Senate on May 20. The bill applies to listed firms, as well as those raising capital in the United States.

Similar legislation is currently in the works in the House of Representatives, but it is still being reviewed by the House’s Committee on Financial Services.

Sponsored by Sens. John Kennedy (R-La.) and Chris Van Hollen (D-Md.), the bipartisan Holding Foreign Companies Accountable Act will, if signed into law, prohibit Chinese firms’ securities from being traded in American exchanges if their audit books cannot be inspected for three consecutive years.

The People’s Republic of China (PRC) currently blocks foreign regulators, such as the U.S. Securities Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB), from inspecting the full audits of publicly traded mainland Chinese companies. Beijing justifies this as a matter of national security.

The Senate bill’s passage comes as the Trump administration tightens the screws on Chinese firms listed on American stock exchanges. On May 14, President Donald Trump told Fox Business that Washington was looking “very strongly” into abuses by PRC companies listed in the United States.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

Companies whose audits cannot be inspected by the PCAOB would have to otherwise furnish evidence that they are not owned or controlled by a foreign government, according to the new legislation.

One drawback to the bill, as noted by Trump, was that many Chinese companies, if barred from the United States, would simply go to other international stock markets, such as London or Hong Kong.

White House National Economic Adviser Larry Kudlow speaking to Fox Business on April 9. (Image: YouTube / Screenshot)

Larry Kudlow, an economic adviser to Trump, said that the administration has been aiming to make U.S.-listed mainland Chinese companies more transparent and accountable to American regulations.

“We have to for investor protection, and we have to for national security,” Kudlow told Fox Business on May 19. “A lot of these companies, by the way, have already had scandals and cost investors a lot of money, because of their failure to be transparent in their reporting. The Chinese government forbids that kind of transparency.”

There were 172 Chinese companies listed on U.S. exchanges that were valued at more than $1 trillion as of September last year, according to an annual report produced by the U.S.-China Economic and Security Review Commission, a Congressional body. These include Alibaba Group, Baidu, and JD.com.

In light of recent financial scandals surrounding Chinese companies listed in the United States, Nasdaq is set to unveil new restrictions on IPOs (initial public offerings) to make it harder for some PRC-headquartered companies to debut on its stock exchange.

On May 19, Nasdaq informed Chinese beverage brand Luckin Coffee it plans to delist the company, a month after the former said an internal investigation found that its chief operating officer had falsified 2019 sales by about $310 million.

In January, short-seller Muddy Waters Research said it would bet against Luckin stock, based on a report that the company was committing fraud.

Chinese video streaming site iQiyi was also accused in April by Wolfpack Research, an activist financial research firm, of overstating its revenue in 2019 by as much as $1.9 billion.

Follow us on Twitter or subscribe to our email list