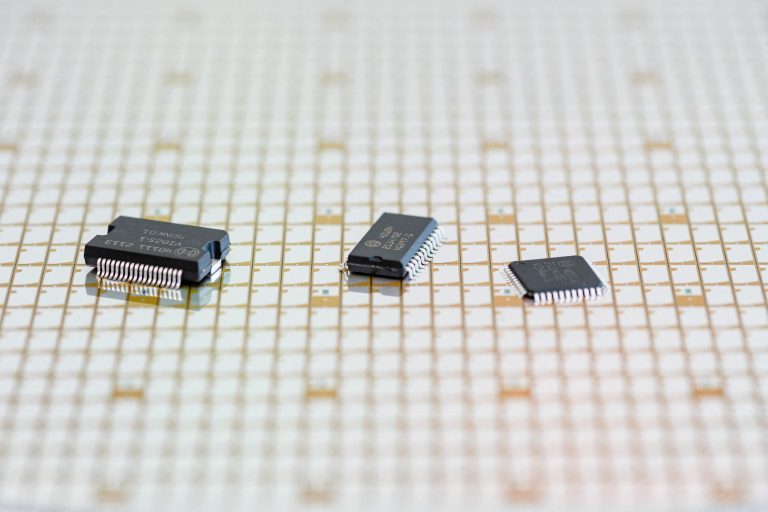

Shortages, supply chains, and security weigh heavily in which chips can and can’t be used

Semiconductors enable nearly every modern industrial and commercial device, from smartphones to aircraft, vehicles, weapons systems, the internet and the electric grid; and are critical to the economic and national security of the United States.

Procuring enough semiconductors, to meet the needs of the U.S. military, has been a challenge however, a deeper challenge is ensuring semiconductors are free of influence by bad actors who seek to undermine U.S. national security.

The U.S. was the first to develop silicon-based microchip technology in the 1950s with significant government assistance. While chip design is conducted almost exclusively by U.S.-based engineers, over the past several decades the fabrication of semiconductors has shifted to manufacturing centers in Taiwan, South Korea, Japan, and China.

The supply chain, responsible for the manufacturing and distribution of semiconductors across the globe, is vast and extremely complicated, allowing opportunities for U.S. adversaries and bad actors to insert themselves into the process and present potential threats to the military and national security.

Complex market for semiconductors

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

As of 2019, North America only accounted for 11 percent of semiconductor production around the globe. South Korea leads the pack with 28 percent and Taiwan 22 percent. Japan produces 16 percent and China 12 percent. Europe and the rest of the world accounts for approximately 10 percent of global semiconductor manufacturing.

But, during the manufacturing life of a single chip numerous other entities have access to these critical components.

A study of a single component for the Joint Strike Fighter found that the component changed hands 15 times before finally being installed in the jet. The component went to Mexico, Costa Rica, Singapore, Taiwan, the Philippines, Japan, Korea, Taiwan (again), Israel, Europe and finally, China. At each point exists opportunities for bad actors to compromise the component or gain intelligence about how the component is utilized.

This component manufacturing life cycle exposes the U.S. to numerous risks including a lack of trusted designs, a potential for individuals to tamper with the components, and the occurrence of reverse engineering and intellectual property siphoning. In addition, this system lends itself to the potential creation of unauthorized copies, counterfeiting and scrap diversion.

U.S. authorities created the Trusted Foundry Program as a response to these vulnerabilities.

The Trusted Foundry Program

The Trusted Foundry Program, also referred to as the Trusted Suppliers Program, was created by the United States Department of Defense in 2004 and was designed to establish a pool of trusted information technology vendors that provide hardware to the U.S. military.

Originally, the scope of the program involved a single manufacturer, IBM, but was broadened in 2007 to include other microelectronics suppliers, like semiconductor manufacturers, in an attempt to secure the entire supply chain.

While somewhat successful, the program is becoming antiquated. Much of the military’s requirements for semiconductors relies on older technology like 12-nanometer chips that are manufactured on American soil. As the U.S. military’s appetite for more semiconductors grows these existing facilities are unable to keep up with demand.

While these older technology chips may be appropriate for the majority of uses, global manufacturers strive to move on to newer iterations of their semiconductors like 7- and even 3-nanometer chips, potentially forcing the U.S. to procure semiconductors outside of supply chains approved for the military.

Another issue is that no matter how large the U.S. military becomes, they are unable to financially compete with the globe’s entire consumer electronics needs. Manufacturers have more of an incentive to serve the broader market than to cater to the American armed forces.

Microchip race

China has been investing hundreds of billions of dollars into semiconductor manufacturing on the mainland with the aim to produce 70 percent of the semiconductors that they use by 2025. They recognize the risk in the supply chain to their ambitions and national security as well.

The U.S. has responded aggressively in the face of Chinese competition.

On May 18, 2021 Senate Majority Leader Chuck Schumer (D-N.Y.) rolled out the bipartisan U.S. Innovation and Competition Act of 2021, previously called The Endless Frontiers Act which passed through the Senate on June 9, and was brought into law with bipartisan support.

While the 1,500-page act addresses numerous areas in the technological sphere and appropriates hundreds of billions of dollars in investment, semiconductors are a main focus.

The act included $52 billion in emergency supplemental appropriations to implement semiconductor-related manufacturing initiatives and R&D programs on American soil.

In addition, $10 billion has been allocated to establish the National Semiconductor Technology Center (NSTC) which will operate as a public-private consortium with participation from the Department of Defense.

It’s anticipated that the U.S. will invest hundreds of billions of dollars over the next decade to mitigate risks to their supply chain and secure semiconductor design and manufacturing on U.S. soil.