America’s central bank, the Federal Reserve, is less than four months away from launching the prelude to the country’s Central Bank Digital Currency (CBDC), the FedNow Service.

The bank’s Board of Governors announced the launch of FedNow in a March 15 Press Release, stating that “the service will debut with financial institutions and the U.S. Treasury on board.”

A timeline for the launch of the service was included in the broadcast. Starting in April, the Fed will initiate “the formal certification of participants for launch.”

“Early adopters will complete a customer testing and certification program, informed by feedback from the FedNow Pilot Program, to prepare for sending live transactions through the system,” the Board stated.

FINANCES AND TECHNOCRATIC SOCIAL CREDIT

- Smart Meters Serve to Nudge Compliance With Carbon Climate Change Narrative

- The Case Against the ‘15-minute City’

- Brazil’s Social Welfare Recipients Must Give Children COVID Vaccine, Alludes New President

- Greece Moves Towards Social Credit as Digital ID App Replaces Drivers Licenses

After early birds have been trained and certified, starting in June, “The Federal Reserve and certified participants will conduct production validation activities to confirm readiness,” the release says.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

“Many early adopters have declared their intent to begin using the service in July, including a diverse mix of financial institutions of all sizes, the largest processors, and the U.S. Treasury,” the announcement adds.

Although FedNow is a processing tool for the U.S. dollar and doesn’t have an immediate connection to any kind of potential Federal Reserve or Department of Treasury issued CBDC, the system immediately installs two critical features of centralization into the banking system that pave the way for potential degeneration into a Chinese Communist Party-style social credit system.

The website for the FedNow Service contains several sales flyers. One focusing on customer payments states the Service’s largest advantage is “its ability to clear and settle transactions in real time — allowing financial institutions (FIs) of all sizes to enable their customers to instantly send and receive money.”

Hub-and-spoke

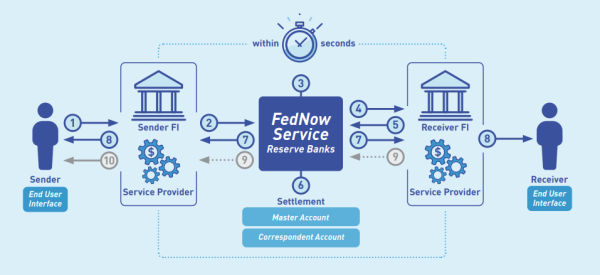

The crux of the matter, a diagram shows, is that all transactions will transition to a hub-and-spoke model where the Federal Reserve is the hub serving your bank as a spoke.

Rather than banks transacting with each other, all payments relying on the FedNow’s instant settlement function will run through the central bank, creating one centralized potential choke point for financial censorship.

The document states that a sender, which can be either an individual or a business, will initiate the transaction through the Service, after which, “The FedNow Service validates the payment message” ensuring the transfer “complies with applicable controls.”

If the transaction is approved, FedNow instantly settles the accounts and funds are debited and credited between the associated accounts.

The documents state that the maximum time allowed for a transaction to complete or fail is 20 seconds.

A familiar notion

Transactions being centralized at the Federal Reserve is a notion championed by November of 2021 Biden Administration nominee for the critical Office of the Comptroller of the Currency (OCC) position Saule Omarova, a Professor at the Cornell University School of Law.

Omarova drew significant ire from both the public and centrist and conservative lawmakers after a paper she authored titled Karl Marx’s Economic Analysis and the Theory of Revolution in The Capital appeared on a copy of her 2017 curriculum vitae.

Omarova declined to present the paper to Senators during her Confirmation Hearings, but attracted even greater ire when a published paper titled The People’s Ledger: How to Democratize Money and Finance the Economy published in 2020 was brought to light, showing the candidate’s desire to convert America’s banking system into one hosted by the central bank.

Omarova called the idea “a blueprint for a comprehensive restructuring of the central bank balance sheet as the basis for redesigning the core architecture of modern finance” and advocated for using the Coronavirus Disease 2019 (COVID-19) pseudo-pandemic as a pretext for “the issuance of central bank digital currency and the provision of retail deposit accounts by central banks.”

She called on the creation of “FedAccounts” that would “be opened automatically upon birth or naturalization” for the purposes of automatically crediting social benefits like pandemic relief stimmie checks and automatic deduction of taxes.

“Offering deposit accounts to individuals and entities will enable the Fed to modulate the aggregate supply of money and credit by directly crediting and debiting the accounts of all participants in economic activity, without interposing intermediary-banks,” the paper reads.

A few weeks later, Omarova was forced to withdraw her nomination after a plurality of Senators made it clear they would not be voting in favor of her confirmation.

Blacklisting

A second document on the FedNow website explains that because transacted payments are both nearly instant and also irrevocable, there are natural risks of what the Fed describes as fraud.

“…it’s crucial to detect and stop fraud as early as possible in the payment flow, preferably as part of the user authentication process,” the document reads.

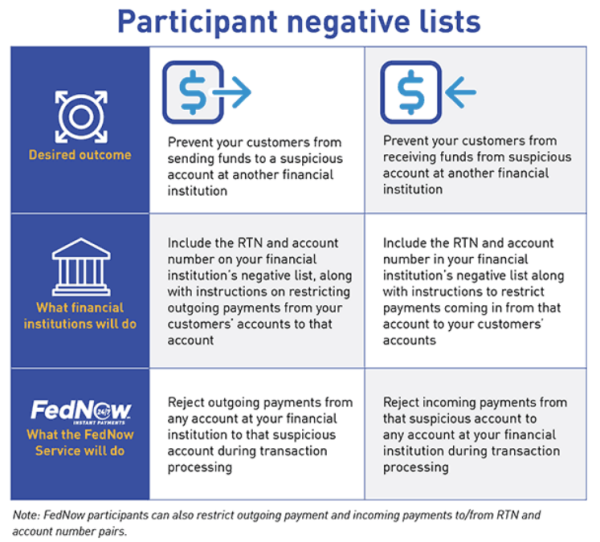

The anti-fraud document explains that in addition to transaction limits of a maximum $500,000 through FedNow, there will also be blacklists affectionately coined as “participant-specific negative lists” that will “provide additional validation during the processing of customer credit transfers and returns.”

These blacklists, the document explains, will lead to an effective lockout from the financial system, “If a payment message fails a business validation check against a negative list enabled by either the sending or receiving FedNow participant, the Federal Reserve Banks will reject the payment message.”

FedNow will directly reject both outgoing and incoming payments to blacklisted accounts.

Lucrative disruption

Both social credit and CBDCs are some of the most lucrative emerging and disruptive markets. According to a 2022 analysis by a marketing firm, worldwide social credit systems are projected to be a $16 billion market as soon as 2026.

Meanwhile earlier in the month, the UK’s Juniper Research stated that worldwide CBDC transaction volume is set to double from $100 billion to $213 billion by 2030 despite only a handful of countries in the Caribbean, Jamaica, The Bahamas, and Nigeria having a fully launched cashless economy.

The revolution appears to be very hard to stop.

International payment processing lynchpin SWIFT stated it would be pushing forward with its implementation of a CBDC settlement system after a trial using a JP Morgan-created proprietary and centralized fork of the Ethereum blockchain between several large institutions and central banks was deemed a success.