On June 1, following months of debates, deliberations, and speculations, the United States Senate chose to reject the Biden administration’s ambitious student loan forgiveness plan — meaning that millions of borrowers across the country must get ready for the resumption of their student loan repayments.

The decision comes at a time when many are still grappling with economic difficulties of the COVID-19 pandemic as well as challenges ensuing from inflation and the rising cost of living. Loan repayments could resume as early as September.

READ MORE: Congressional Repeal of Biden’s Student Debt Forgiveness Sparks Potential Presidential Veto

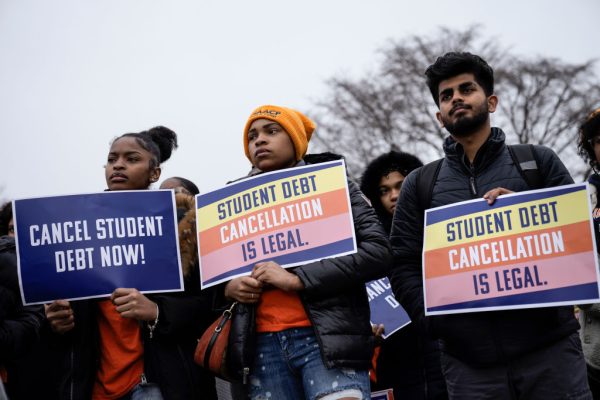

Throughout his campaign and early presidency, Biden vocalized his commitment to provide relief for student loan debt. His proposal suggested forgiving up to $10,000 in student loans per borrower earning a maximum of $125,000 a year ($250,000 for married couples).

More than 41 million Americans are currently paying student loans, owing a collective amount of over $1.7 trillion, according to data from the Federal Reserve.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

Despite these alarming numbers, however, the plan faced substantial pushback in the Senate, and was ultimately rejected after analysts projected the proposal could lead to expenditures reaching as high as $400 billion.

“This Biden proposal undermines these programs and forces hard-working taxpayers who already paid off their loans or did not go to college to shoulder the cost,” said Senator Joe Manchin (D-VA), one of the few Democrats to vote against the proposal.

“I voted to repeal the Biden Administration’s student loan cancellation proposal because we simply cannot afford to add another $400 billion to the national debt,” he said.

Student loan payments to resume in the fall

The timing of this decision is of particular concern, as the pause on student loan repayments is set to end soon. Many borrowers are unprepared to have to resume payment on their loans. A recent survey conducted by the Student Debt Crisis Center found that 93 percent of those with debts did not feel ready to restart repayments.

The survey sampled 23,000 student loan borrowers. It found that women hold around two-thirds of the nation’s student debt, and Hispanic and black graduates held more debt than those of whites and Asians.

“The payment pause has meant everything,” said Allison Newmes, one of the respondents. “There are no words; I don’t know how we’re going to find an extra $600 a month,” Newmes, 44, said. “It’s like we’re falling through the cracks.”

Heated arguments on both sides of the aisle

Amid the heated conversation, arguments for and against the student loan forgiveness plan have come forth. Proponents claim it would stimulate the economy to help reduce financial stress for individuals and allow them to invest in tools to build long-term wealth such as homes, cars, and businesses.

“This decision would unleash immediate and devastating repercussions for the lives of 40 million Americans burdened by student debt and their families. It is shameful that legislators would endorse measures that harm the very heroes in our communities — veterans and nurses — who are still grappling with the aftermath of the pandemic and its profound economic impact,” said Natalia Abrams, Executive Director of the Student Debt Crisis Center.

On the flip side, opponents argued that forgiveness might unfairly benefit high earners with advanced degrees, who are more capable of repaying their loans, and tacking $400 billion to the national debt would be detrimental to the economy — and affect lower-income people disproportionately as a result.

“45 million people with student loan debt will never forget when politicians, led by Republican extremists, went out of their way to push millions of working families, including their own constituents, into economic catastrophe by passing this reckless CRA resolution,” said Student Borrower Protection Center Executive Director Mike Pierce in a statement.

Looking ahead

As we move forward, the need to address the student loan debt crisis becomes more urgent, lenders and activists say. Despite being a complicated issue — entwined with broader discussions about the cost of higher education, wage disparities, and the financial stability of the American middle class — a sustainable solution is imperative.

When repayments once again resume, the owed sums will be virtually unchanged, given that the interest on the majority of federal student loans was put on hold during the government’s suspension of payments, experts say.

It is also important to note that even with the rejection of the forgiveness plan, there are still several repayment options available to borrowers. These include income-driven repayment plans, which cap monthly payments at a percentage of the borrower’s discretionary income. There is also the possibility of loan forgiveness for individuals who work in public service.

During and since the COVID-19 pandemic, the U.S. has also seen significant labor shortages, especially in the service sector and blue-collar industries, driving up wages and hence opportunities for those looking to do work.

For more information regarding student loan assistance and repayment plans, visit the Federal Student Aid and Sallie Mae websites to see what options are available to you.