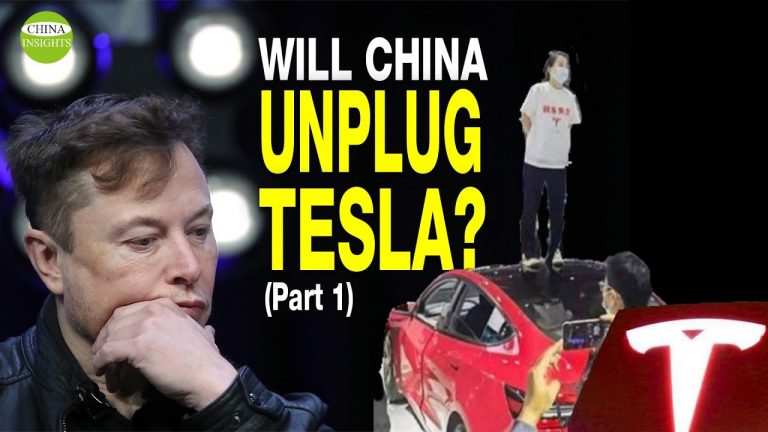

The leading producer of electric vehicles has found itself in a suspicious storm of criticism in China after a Tesla owner made a widely publicized protest at a car show in Shanghai.

On April 19, a woman wearing a white T-shirt emblazoned with the words “breaks failed” and the Tesla logo upstaged the company’s booth at the Shanghai Auto Show. The woman claimed her Tesla vehicle failed to stop, causing damage to the front of the car and nearly killing her and her family in a crash that occurred earlier in the year.

The details of the woman’s claim are hard to back up, as data shows that the car was braking safely dozens of times in the 30 minutes leading up to the accident, including multiple stops from speeds in excess of 100 kilometers per hour (more than 60 miles per hour). Chinese traffic police had previously concluded that the woman’s father, who was driving the vehicle, was responsible for the crash, as he had been speeding at the time of the accident and violated other traffic rules.

The woman was escorted from the car show minutes after besieging the Tesla booth. Tesla offered her an apology for not resolving the incident more quickly, but otherwise stuck to its guns, rejecting her demand for a full refund.

However, the incident seems to portend an ominous turn for the American company’s future in China.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

Chinese state media and even Communist Party organizations quickly picked up and amplified the story. Xinhua, China’s biggest media outlet, questioned, “Who gave Tesla the audacity to ‘not compromise?’ The People’s Daily warned, “No product is irreplaceable.”

Even the Central Commission of Political and Legal Affairs (PLAC), the Chinese Communist Party (CCP) organization that controls the country’s courts and police, offered an opinion on the row.

In an article it published on its official WeChat page, the PLAC wrote that “Tesla must face the grill of Chinese customers.”

Storm clouds over Tesla?

The official criticism has begun to spill over into official action. On April 24, the traffic division of Guangzhou city in southern China banned Tesla cars on several roads. Multiple Tesla cars were pulled over at highway or expressway entrances without the owners being given a specific reason. Vehicles of other brands were allowed to pass with no problem.

Previously, some Chinese parking administrators also banned Tesla vehicles from entering parking lots, saying that cameras built into the cars could violate privacy.

China is Tesla’s largest market after the U.S., accounting for about a quarter of the company’s global sales in 2020. Last year, Tesla’s revenue in China reached $6.662 billion, an annual increase of 123.63 percent, accounting for 21.12 percent of Tesla’s global revenue. It is second only to the U.S. market which is 48.22 percent.

Since the 1990s, the CCP has banned foreign car companies from setting up sole subsidiaries in China, forcing foreign companies to set up 50-50 joint ventures with Chinese entities where they share profits, technology, and expertise with their Chinese counterparts.

But in 2019, with Communist China facing unprecedented external challenges and internal pressure in the midst of the U.S.-China trade war, Tesla received a rare green light to become the first Western car company to build a solely owned factory in China.

However, observers have warned that Tesla — headed by the storied technocrat Elon Musk — could be soon finding the limits of the Party’s magnanimity.

Chinese consumers are unlikely to reject Tesla, and the government is well aware of the brand’s reputation. A month ago, China released its annual “Complaint-to-Sales Ratio Ranking” for 2020. Tesla was the best performer, selling 100,000 units with only seven complaints. The worst performer was a model “BYD Qin” made by Chinese electric car maker BYD, which received 360 complaints about 100,000 units sold — 51 times that of Tesla.

One Chinese netizen wrote: “If you don’t know what to buy, go online and see what people are boycotting, [and buy that.]”

In February, the Communist Party’s General Administration of Market Supervision and the Central Internet Information Office, and five other departments interviewed Tesla over consumer complaints about quality, issuing a warning to the electric car maker to “strictly comply with Chinese laws and regulations.

In March, Tesla was accused of being a “spy car” and was restricted from use by those working in China’s military, state-owned enterprises in sensitive industries, and senior official posts. In response, Tesla China issued a statement saying that the vehicles used by Tesla users in China do not violate the privacy of the user through the in-car camera.

Edging out competition

Tesla has invested heavily in building a large number of charging stations across China. Tesla electric vehicles have a real-life range of up to 300 miles, which is only one of the features unmatched by many Chinese domestic electric vehicles. Tesla’s brand, quality, and a price tag of just over 300,000 yuan (roughly $46,000) have given Tesla a number one position in the electric car market in China.

New energy vehicles are one of the strategic projects of the CCP to compete for the future high technology field. Last November, China released the “New Energy Vehicle Industry Development Plan (2021-2035)”, which plans to have new energy vehicles account for about 20 percent of total new vehicle sales by 2025, and to make pure electric vehicles the mainstream of new vehicles sold by 2035. According to data from the China Association of Automobile Manufacturers, the share of new energy vehicles in China was only 5.4 percent in 2020. Both government policies and data send a strong signal that new energy vehicles will have a rapid growth period in China in the next decade or so.

In China, a number of well-known cell phone makers have announced their entry into the smart electric vehicle manufacturing industry. For example, on the evening of March 30, China’s Xiaomi announced that it plans to set up a wholly-owned subsidiary to handle the smart electric vehicle business. This company was listed as one of nine companies on the U.S. Department of Defense’s “Blacklist of Chinese Communist Party Military Enterprises” in January 2021.

More notably, Huawei unveiled a series of smart cars Alfa S on April 17. It entered its first motor show on April 19 right after.

Though nominally a private company Huawei has extensive suspected links to the People’s Liberation Army military and the Chinese intelligence system. Having suffered a major blow in the cell phone industry, Huawei quickly shifted its strategic focus to new energy vehicles. Instead of launching its own independent brand of EVs, Huawei has chosen to partner with three Chinese automakers, BAIC, Chang’an Auto, and Guangzhou Auto in an approach dubbed “Huawei Inside” to create three respective sub-brands. One of such new energy vehicle brands made with BAIC is ArcFox, which has just launched its first series of electric cars, the Alpha S.

According to official statistics, the cumulative production capacity of new energy passenger cars of China’s major automakers has exceeded 20 million units. However, the total retail volume in 2020 was 1.109 million units. In other words, there is nearly 20 times more production capacity waiting to be absorbed by the market.

Tesla has been reducing its prices by up to 30 percent since 2021. This has further squeezed the market for the new domestic players’ brands such as NIO, XPeng Motors and Li Auto, which are lagging behind Tesla to begin with.

Tech transfer

The Chinese government has given Tesla huge incentives to invest in China. In 2018, Tesla received approval to build a factory in Shanghai, making it the largest foreign-funded manufacturing project in the city. Other benefits offered include tax incentives, low-interest loans, and permission to build a factory that is solely owned by a foreign identity.

Tesla has made many of its technologies and designs available to its Chinese counterparts. Observers say this is why players from other industries in China are able to enter the smart car industry.

However, according to expert analysis, even with Tesla’s designs, they cannot build a high-quality smart car using the technology that’s available in China. All key parts such as sensors need to be imported. As a result, the cost of building an electric car would be higher than Tesla. It is no surprise to hear some Chinese industry insiders express, “If Tesla is not driven away, no one would buy China-made new energy vehicles priced at more than 100,000 yuan. The series of policies launched in different parts of China to offer subsidies on electric vehicles and place restrictions on gas vehicles would be equivalent to making promotions for Tesla.”

So what does the CCP want most from Tesla? At the moment, one of the more obvious answers is Tesla’s data.

Electric cars, the intelligence of automotive AI relies on the collection and analysis of large amounts of data. Tesla, with its huge market share, is undoubtedly ahead of many of its Chinese and international counterparts in terms of data. The raw data of electric vehicles often contains inside many of the core technologies of autonomous driving. Through the collection and analysis of these data, some sensitive technology is likely to be revealed to Beijing.

On April 22, the same day that Tesla began taking heavy criticism, the China Association of Automobile Manufacturers (CAAM) proposed that the government revise and supplement relevant regulations and standards for intelligent networked vehicles, and further improve the data monitoring system by adopting a polycentric data governance model. The “polycentric data governance ” means that in order to improve the data monitoring system, the data of foreign enterprises like Tesla cannot be placed in the United States. Instead, data from the Chinese market should be held in China.

Last February, William Evanina, director of the U.S. Counterintelligence and Security Center (NCSC), said that stealing U.S. aircraft technology and electric car technology are two of the main focuses of Communist espionage efforts.

Tesla’s global vice president Tao Lin has publicly stated that Tesla is building a data center in China, which is expected to be ready in the second quarter of this year. The data center is Tesla’s own, but a part of it will cooperate with Chinese companies.

Last year, Steve Saleen, founder of American specialty vehicles brand Saleen Automotive, revealed that Saleen Motors of China had stolen nearly 40 years of intellectual property from him. In 2016, Steve Saleen began a partnership with a company from Jiangsu Province in China, which guaranteed Saleen and his U.S. partners would maintain a majority stake in the company, which Saleen claims to be “a sham deal.” He pointed out that the company, Jiangsu Saleen Automotive Technologies (JSAT), had registered upwards of 510 Saleen patents in China for various types of automotive design, technology, trade secrets and engineering research and development without his consent. In addition, in almost all of the company’s patent applications, Steve Saleen is not listed as the patent holder.

According to Chinese media, Jiangsu Saleen Automobile, a smart car manufacturing company, has raised a total of 6.6 billion yuan from various parties, especially from the Chinese government. Despite this, it has sold only 31 vehicles so far. Its Chinese owner is suspected of corrupting state assets and is currently under investigation by a local Chinese court.

By Lin Chen. Leo Timm contributed to this report.