Pressed by senior leaders anxious about the declining economic growth, the People’s Bank of China (PBOC) announced earlier this week that it would cut the reserve requirements of banks. It would consequently allow these institutions to have more cash to hand out loans. The decision was contrary to what the bank had earlier indicated and came as Beijing launched an inquiry into the central bank and other financial institutions.

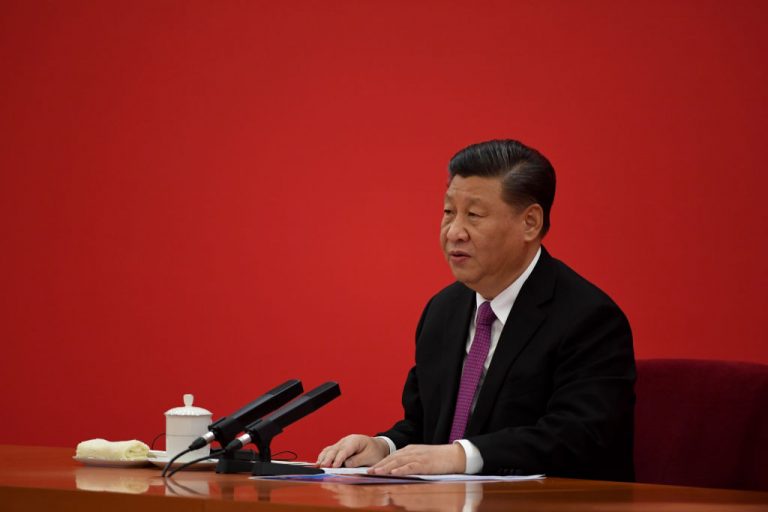

The PBOC is probably the most significant among all the financial institutions being investigated by Xi Jinping’s inspectors. It administers the world’s largest financial system and has worked for years to build credibility among investors at home and abroad.

Over the last few weeks, Communist Party discipline inspectors from China’s top anti-corruption division have visited the central bank’s headquarters in Beijing. Bank officials told the WSJ that they were interrogated by the inspectors who also inspected documents and delivered a surprisingly tough message: Any expression of central bank independence will not be entertained by Beijing. Similar to other wings of the government, the monetary authority is accountable to the Party, the inspectors insisted.

The PBOC is one of the 25 critical financial institutions that are being investigated by Beijing’s inspectors. The objective of the review is to ascertain whether these financial institutions had become too intimate with private firms and whether regulators like the PBOC have been too negligent about warding off the risks posed by companies like Ant Group or the $300-billion debt-laden China Evergrande real estate group.

Unlike the central banks of the West, the PBOC has never been politically independent. But it had enjoyed a unique standing in the country’s economic order. However, President Xi Jinping has remodeled the economy. He focused on steering communist China away from Western-style capitalism, which is eroding the special status PBOC has enjoyed.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

A perfect example of the unstable situation is the PBOC’s flip-flop on the reserve requirements. In October, Sun Guofeng, head of the central bank’s monetary policy department, dismissed the prospect of the PBOC lowering reserve requirements of banks. But Chinese leadership has been facing pressure to contain the crisis developing in the property sector. One way to do so would be to ensure real estate companies get loans.

In a Dec. 10 video call with the International Monetary Fund (IMF), Managing Director Kristalina Georgieva and Chinese Premier Li Keqiang pledged to cut the reserve requirements. Three days later, the central bank announced the cut, showing it is acting in accordance with Beijing’s dictates. Despite its emphasis on policy discipline, the PBOC might be forced to slash the rates further to protect the economy. Interest rate cuts could also happen next year, according to economists.

“The PBOC has carved out a modest amount of operational autonomy to push forward financial liberalization and a more market-oriented monetary policy framework…That notion of operational autonomy is now coming into conflict with a more intrusive role of the government in the economy…The PBOC is losing,” Eswar Prasad said. He is an economics professor at Cornell University and former China head of the IMF.