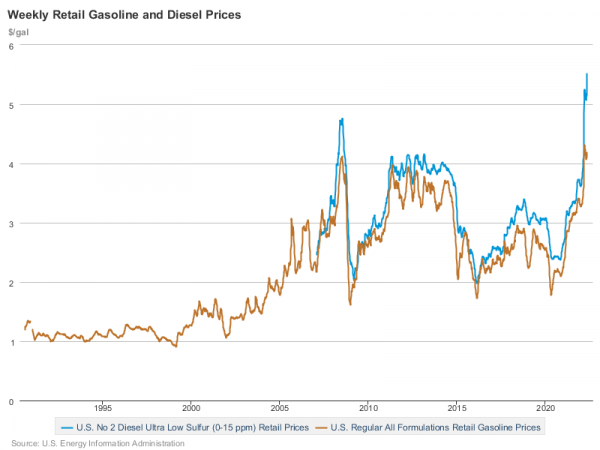

The price of ultra low sulfur diesel (ULSD) in the United States not only suddenly broke sharply away from the price of regular gasoline, but set a new 25-year high according to new data released May 2 by the U.S. Energy Information Administration (EIA).

The resulting price increase has many truckers paying four digits per fill up as they transport the nation’s goods.

ULSD posted a sudden 6.7 percent increase during May 2 reporting with an average price of $5.509 per gallon, compared to $5.160 the week prior and $3.613 on Jan. 3.

The previous historical high of $4.733 per gallon, according to EIA data, was posted July 7, 2008, and was defeated March 7 this year when the crucial commodity notched $4.849 shortly after the Russia-Ukraine conflict broke out.

$5.509 per gallon represents the highest price ever recorded for ULSD, the most commonly used form of distillate fuel, in the United States.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

By comparison, gasoline remained flat at an average of $4.182 per gallon the same week. However, west coast gasoline prices averaged $5.099 per gallon.

Why is diesel more expensive than gasoline?

According to an EIA FAQ sheet, the three primary reasons that diesel is more expensive than gasoline are:

- Increasing demand, especially in Europe, India, and China

- Environmental regulations driving the need to refine diesel to ultra low sulfur standards

- A 6 cents per gallon higher federal excise tax of 24.3 cents per gallon.

Additionally, the Administration stated that out of a 42 gallon barrel of crude oil, only 11 to 12 gallons of ULSD are produced compared to 19 to 20 gallons of gasoline.

Semi-truck tank size and fuel economy

Transport industry media outlet Freightwaves stated in a January of 2020 explainer that “most big rigs in the U.S.” are equipped with fuel tanks between 120 and 150 gallons.

Additionally, trucks that are deployed for long haul operations are often equipped with two tanks.

SUPPLY CHAIN AND ECONOMY ARTICLES

- Russian Gas Exports Soar Even as Kremlin Requests Payment in Rubles

- Oil Used in Oreos and Toothpaste Becomes 10% More Expensive After Indonesia Bans Exports

- 5 Million Honeybees Die After Being Left Upside Down on Atlanta Airport Tarmac

- Critical US Power Grid Hardware Wide Open With Backdoors, Warns CISA

“Longer distance fleets tend to run two tanks with the higher capacity 150-gallon tanks offering the highest mileage range and best options to purchase fuel at the lowest possible retail price,” they stated.

At the time, diesel was approximately $3.00 per gallon, and the outlet estimated a double-tank rig to spend approximately $900 to fill up.

Freightwaves estimated the average fuel economy of a big rig at 6 to 8 miles per gallon, depending on aerodynamics equipment, meaning 300 gallons of fuel would fetch between 1,500 and 2,000 miles.

Not buying the ‘Putin price hike’

Reality TV icon Mike Rowe of Discovery’s Dirty Jobs fame told Fox & Friends during a May 2 interview that people he knows in the industry don’t buy Joe Biden and the White House’s narrative that record gasoline and diesel prices are caused by the “Putin price hike.”

Rowe told the outlet that people he knows in the business have told him grappling with skyrocketing costs of doing business is like “falling down the stairs in slow motion.”

“They’re just sending me videos of them at the gas pump and some of them are filling up 18-wheelers. And, I’m not kidding you, $1,100, $1,200,” he stated.

“When you put $1,200 in your gas tank and just six months ago it was costing you $600 or 700, the exponential reality of it is starting to sink in. You just can’t walk that back. It touches every single thing that matters in this country. From food production to transportation…all of it.”

At the end of March, a poll by Quinnipiac University found that overall, 41 percent of Americans, the majority of respondents, placed the blame for rising gas prices at the feet of the Biden Administration’s economic policies.

Second place was a tie between two 24 percent clusters, where one set of respondents blamed the Russia-Ukraine war and the other felt that oil companies were simply charging more.

The survey found that the opinion was sharply fragmented among party lines, with 82 percent of Republicans blaming the current administration’s economic policies, while 41 percent of Democrats blamed the war and oil companies equally.

Only 3 percent of Democrats blamed the Biden Administration’s economics for the price increase, stated a report by WCSC news.

ULSD imports, exports, and production

Although import data from the EIA is only current through February, data nonetheless shows that total imports of ULSD from all countries spiked suddenly to more than 11 million barrels compared to 7.16 in January.

The greatest increase in imports were from Saudi Arabia, where 1.471 million barrels were imported in February compared to 185,000 the month prior, and Russia, where 2.157 million barrels were imported in February compared to none in January.

Notably, imports from Canada actually decreased to 4.291 million in February compared to 4.927 in January.

In an explainer, the EIA states that in 2020, although U.S. refineries produced 1.66 billion barrels of ULSD compared to only 1.37 billion barrels used in domestic consumption, America nonetheless imported approximately 80 million barrels, mostly from Canada, while exporting 370 million barrels.

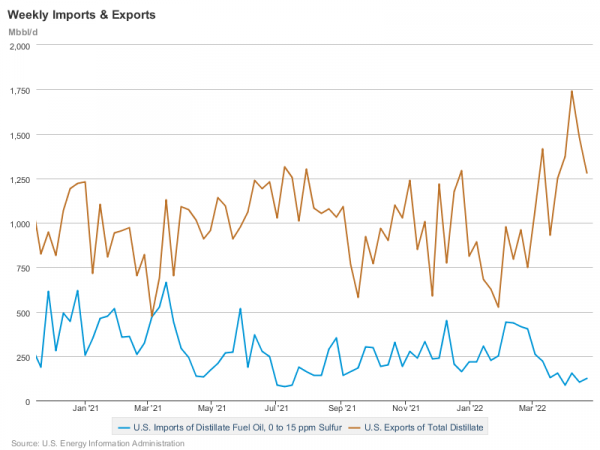

However, the most recent import/export data published by the Administration is current until April 22, and shows that since February, imports have dropped dramatically while exports have increased tremendously.

The EIA’s export data is limited to “total distillate” figures, which includes all grades of diesel, while import data is provided for ULSD alone

Data for Jan. 28 showed that 527,000 barrels per day of total distillates were exported and 250,000 barrels per day of ULSD were imported.

One week later, the U.S. suddenly began exporting 976,000 barrels per day of total distillates while imports remained flat.

This pattern remained relatively stable until data for March 11 showed an explosive jump to 1.415 million barrels per day exported while imports fell to 222 thousand barrels per day.

By April 8, this trend exacerbated further to 1.739 million barrels exported with daily imports falling to 154,000 million barrels.

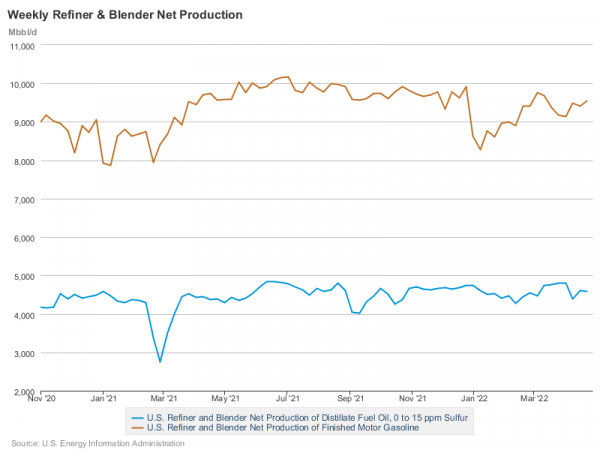

EIA data on refinery production also showed that while gasoline production has increased from 8.267 million barrels in the first week of January to 9.554 million daily as of the most recent reporting period, April 22, ULSD production has remained relatively flat, opening the year at 4,602 million daily barrels and posting 4.586 million daily barrels daily on April 22.

A ‘crisis’

At the end of March, establishment media outlets such as CNBC were already sounding the alarm that the price of diesel, which farmers, truckers, and most heavy industry rely on, was a critical driver of inflation.

Tom Kloza, Head of Global Energy Research at the Oil Price Information Service (OPIS), told the outlet, “I’ve started to use the term diesel ‘crisis.’”

“It clearly is a crisis that’s happening before our eyes,” he stated. “I wouldn’t rule out lines, shortages or $6 [price] in places beyond California.”

And Kloza’s foresight may have been accurate. May 3 reporting by Financial Express citing data from CRISIL Research stated that in April, the transport industry’s fleet utilization levels remained flat, and combined with the jump in fuel prices, drove cash reserves down to 19 percent from 21 percent in March.

The article stated, “Freight rates for consumer essentials…loose goods, and mining applications rose sharply.”

‘Eye-popping margins’

May 2 reporting by BNN Bloomberg stated that U.S. refiners were posting big quarterly returns on “near-record high diesel margins” in spite of “simmering concern that there won’t be enough gasoline to meet summer driving demand.”

“It’s a balancing act,” the article explained. “Refiners will likely continue maximizing diesel output for domestic consumption and for export because of the eye-popping margins to make the industrial fuel.”

“At the same time, emphasizing diesel comes at the cost of gasoline production and threatens to further elevate already-high domestic pump prices.”

The article explained that the “crack spread” for commodities futures on the New York Mercantile Exchange hit a new high for diesel at $67 on May 2, compared to only slightly over $40 for gasoline.

The term crack spread is defined by Investopedia as “the overall pricing difference between a barrel of crude oil and the petroleum products refined from it.”

This means that under current economic conditions, futures contracts for gasoline are running a $40 premium over crude oil, while diesel is at a $67 premium.

By comparison, a chart in the article showed the crack spread for both diesel and gasoline were only $10 in August of 2020.

A ‘glimmer of hope’

Retail-focused market analyst website Zero Hedge explained that the crack spread situation “indicates that demand for refined products, mostly diesel, is so strong that refiners have only limited spare capacity to meet it.”

But added that there is a “glimmer of hope” in that many refineries that were offline during lockdowns induced by Coronavirus Disease 2019 (COVID-19) measures have started to come back online “as they begin ramping up for high-demand summer season, the tightness in the refined-product market may ease.”

But added the caveat, “Of course, if demand destruction in diesel does not materialize soon, and remains at current high levels just as summer gasoline demand spikes, then all bets are off.”