By Cheng Fan, Vision Times Staff

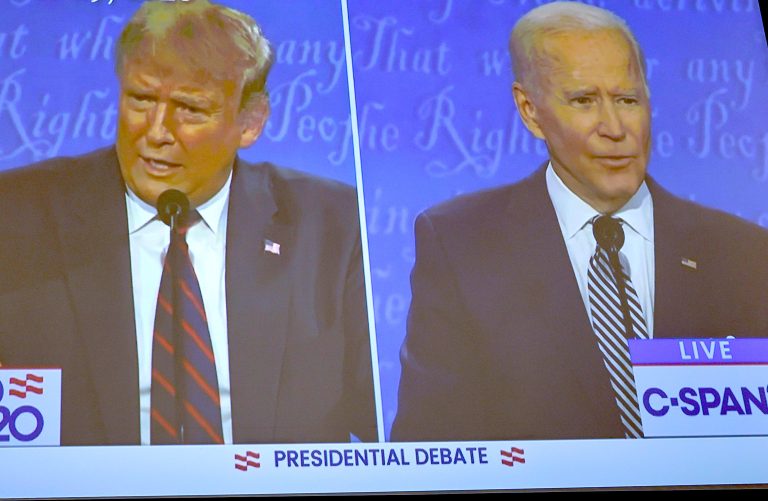

As former President Donald Trump inches closer to securing the Republican Party’s presidential nomination, the possibility of him once again challenging Biden has become a focal point for investors. Biden actively promotes his green energy policy, rejecting fossil fuels, and imposing additional technological restrictions on Communist China.

By contrast, Trump focuses on trade development, tariff increases, and engaging in a trade war with Beijing. Additionally, he opposes ESG (Environmental, Social, and Governance) and plans to alter American energy policies.

Historical data indicates that the U.S. stock market tends to perform strongly before each presidential election. However, different industries show varying performances. Goldman Sachs released an analysis report stating that technology stocks often exhibit the worst performance in the year leading up to the presidential election, while sectors such as utilities and consumer goods perform relatively well.

- New Hampshire Republicans Hand Trump Victory in State Primary, But Haley Stays in Race

- ‘This is not over’: Texas Gov. Abbott Vows to Defy Supreme Court’s Ruling on Southern Border

Whom will Big Oil favor?

Some analysts suggest that energy policy may become a crucial issue for both the Democratic and Republican parties in November.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

Keith Bliss, global head of markets and strategy for BloxCross, stated that Trump promised to relax energy production regulations and cancel Biden’s support for green energy subsidies during his campaign. This move would be favorable for the oil industry.

He told Yahoo Finance that if Trump is elected, major oil companies would likely export more oil to new markets. “When you sum up the reduction in cost, the access to new markets, the reduction in regulation costs, and the ability to produce additional products with increased feedstock, then Big Oil will make even more money.”

In contrast, during Biden’s tenure, he has actively promoted renewable energy while cracking down on the fossil fuel industry. If he is re-elected, Bliss believes that oil giants would “struggle,” as the administration is likely to become even “more aggressive” than it is now.

America’s automakers in peril

Jim Farley, CEO of Ford Motor, told Yahoo Finance earlier in January that “we’re seeing mainstream customers who are interested in EVs, but they’re not convinced, and they’re not going to pay a big premium.”

“What it means for the [manufacturers] is cost — we have to dramatically reduce the cost.”

- Hertz to Sell 20,000 Electric Vehicles, Invest in Gasoline Cars Instead

- Toyota Head Questions EV Dominance, Champions Hybrids and Hydrogen Fuel

Various automakers have joined the government’s ambitious electric vehicle (EV) sales targets since Biden took office, and electric vehicle sales have quadrupled. However, the transition to electric vehicles has proven to be a costly process for traditional automakers.

According to Reuters, Ford announced on Jan. 24 that the company expects to incur approximately $1.7 billion in pre-tax revaluation losses in its fourth-quarter earnings for 2023, related to its employee pension fund and other retirement benefits.

In addition to Ford, General Motors (GM) is also experiencing losses in its electric vehicle ventures.

Bliss said that the three major American automakers — GM, Ford, and Chrysler — will have to continue struggling.”

“They haven’t figured out the EV market yet, and if Biden comes back in, the government will keep pushing the EV story,” Bliss said.

The China question

Regardless of who wins the election, Chinese companies will face challenges, and for U.S. chip manufacturers like Nvidia (NVDA), neither candidate brings good news.

Trump had proposed a comprehensive 10-percent tariff on all imported goods, saying that such is necessary when foreign companies “dump” products in America.

- What Are the Aims of the CCP’s Constant Naval Presence in the Taiwan Strait?

- Some Chinese Goods to Remain Exempt From Trump-era Tariffs Until June 2024

Shehzad Qazi of China Beige Book warned that both Trump and Biden’s stances on China might make investors and business decision-makers nervous. “I think we’re going to see a lot of aggressive maneuvers on the China front,” he told Yahoo Finance.

Marcus Noland, Vice President of the Peterson Institute for International Economics (PIIE), told Agence France-Presse that a “trade war,” especially with China, would be a crucial step in Trump’s return to implementing economic policies.

Biden’s ongoing measures against China’s high-end development will put chip giants in the crossfire, while Trump has proposed tariffs of up to 25 percent on Chinese tech manufacturers.

“Biden has not been friendly to China, but Trump’s going to be even worse,” Lee Munson, President of Portfolio Wealth Advisors, told Yahoo Finance Live. “When you look at Trump, he’s mercurial and could just cut off the tap… and tell Nvidia they can’t sell anything” to mainland China.

In 2023, leading artificial intelligence companies like Nvidia and AMD derived at least 20 percent of their revenue from the Chinese market.

Munson added, “Companies that rely on China for sales or for supply chains are going to have to adapt.”