Bitcoin, the world’s foremost cryptocurrency, is often hailed by supporters, pundits, and influencers alike as the common man’s hope of salvation from the trappings of fiat currency such as inflation and centralization. However, Bitcoin, originally created by the mysterious online persona “Satoshi Nakamoto” as a decentralized peer-to-peer electronic cash system — structured in such a way that it would not be annihilated by the U.S. government as predecessors such as Liberty Reserve were — has mutated into something quite far from its creator’s stated vision.

Bitcoin now not only seems to be firmly in the hands of Communist China, but may be a major contributor to the ongoing global semiconductor shortage and the unprecedented crises many power grids all over the world face.

Mining: a euphemism for data centers

Bitcoin (BTC) is, in essence, a shared transaction ledger using a type of database known as a blockchain. The term “mining” was coined because Bitcoin’s software was designed to manifest the currency as a reward to those computers who made themselves the data center transactions rely on.

Some 13 years ago, in the beginning of Bitcoin, long before the currency could be traded for the astronomical sums of U.S. dollars it goes for today, the software could be run on a laptop or a desktop computer, and coins were both abundant and worthless. After all, there were no exchanges BTC could be traded on for dollars, they have no underlying value or use besides trade between users, and the world not only didn’t understand what Bitcoin was or how it worked, but was also skeptical of it.

On May 18, 2010, the world was so Bitcoin shy that Laszlo Hanyecz made history when he offered 10,000 BTC to the first person who would have pizza delivered to his house. Someone took him up on the transaction, providing two large Papa John’s pies, in what is perhaps the most famous trade in cryptocurrency’s history.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

Hanyecz’s pizzas were worth more than $600,000,000 USD in April.

How the system works is less arcane than it appears to outsiders. Bitcoins, which can be divided down to eight decimal places, can be sent from one user to another. When a user sends a coin (or a fraction of a coin) from one wallet to another, they report that transaction to the Bitcoin network in exchange for a small fee, which is paid to those who contribute computing power to the network to exact the transaction. These contributors are called “miners.”

The computing power, however, is not at all utilized to process transactions per se. Instead, the software works something like a lottery, running a hash of the SHA256 encryption algorithm. The first computer to find the correct answer for each “block” of transactions processes the transactions in the block and is awarded a set number of Bitcoins in addition to the fees paid in all the transactions in the block. This is known as “finding” a block.

In the beginning, the software awarded the miner of each block 50 BTC. Bitcoin was created to only ever create 21 million Bitcoins, so the software is programmed to half the block reward every time 210,000 blocks are found.

A 2018 study by analysis firm Chainalysis found that nearly 4 million of the currently mined coins on the Bitcoin blockchain are lost and unrecoverable.

February of 2019 was the last halvening and the current block reward today is 12.5 BTC. Eventually, this number will reach zero and miners will decide which version of a new software protocol to utilize.

Naturally, the more computing power (“hashrate”) added to the network the faster each SHA256 puzzle is solved, the faster each block of transactions is processed and added to the chain, and the faster those who own the mining hardware receive their bounty.

In order to throttle the rate at which BTC’s finite supply is paid, the software is configured to average block time to approximately 10 minutes. It does this by increasing the difficulty of the SHA256 calculation in proportion to the hashrate every 2016 blocks, which is theoretically every two weeks.

The increase in difficulty means the amount of coins each miner generates decreases, which is what has ultimately led to the long running cryptocurrency mining arms race. More and more computing power has to be added to the network in order for the same miners to stay profitable, or as profitable as they would like.

Notably, profitability is determined by whether the amount BTC generated is greater than the electricity consumed to operate the data center.

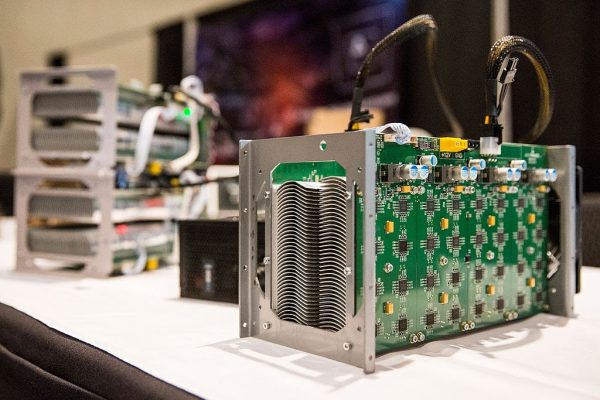

For many years, home computers have no longer been sufficient to produce enough computing power to handle the difficulty set by the Bitcoin hashrate. Instead, SHA256 crypto mining has long since evolved to using specialized hardware known as an Application Specific Integrated Circuits (ASIC), which is a fancy way of saying a semiconductor that is designed to do one thing and one thing alone: hash the SHA256 lottery and attempt to win coins for its owners.

Because of the move away from home computers to specialized hardware, Bitcoin “mining” is now a euphemism for industrial sized data centers housing hardware that does nothing but hash SHA256 and the extensive HVAC systems needed to cool them.

Hashrate centralized in China

Regardless of how much hashpower each data center can create, finding blocks is still mathematically random and is subject to statistical variance. Because of this, miners form “mining pools,” which are effectively cartels of different data centers, except virtually anyone with a miner can join.

When one miner within the pool finds a block, the coins are paid to the pool and divided by the pool to its miners in proportion to the amount of hashrate each individual is supplying, leading to a more stable flow of income.

Because the Bitcoin blockchain is transparent, which pool finds a block is publicly available knowledge. According to data from BTC.com, the top five mining pools in the last year of data are, in descending order, F2Pool, Poolin, BTC.com, AntPool, and Huobi Pool. These five pools combined to find approximately 61 percent of all blocks as of May 24. All five pools are either Chinese or linked to China.

Huobi is a Chinese-founded cryptocurrency exchange, AntPool and F2Pool’s All Rights Reserved links to the same gov.cn domain, BTC.com was purchased by 500.com, which is owned by keystone mining rig manufacturer Bitmain’s former CEO, Jihan Wu, in February, and Poolin is headquartered in formerly-democratic Hong Kong.

Also in the top 12 are Binance Pool, ViaBTC, Lubian.com, OKExPool, and BTC.top. These pools are also Chinese-connected and comprise an additional 24 percent of all blocks found in the last year.

Recent developments in 2021 have shed some light on how centralized Bitcoin’s data centers are in the hands of Communist China. In April, a coal mine in the Xinjiang Autonomous Zone flooded, trapping at least 21 miners. As a result, coal delivery was halted to power plants in the area, which caused several data centers operating Bitcoin miners to go offline, immediately reducing the total hashrate on the BTC network by as much as 35 percent, according to Fortune.

In mid-May, the Chinese Communist Party (CCP) banned banks and payment services from processing transactions related to crypto or conducting exchange between crypto and either the Yuan or foreign fiat currencies. On May 13, the Bitcoin network posted a high for hashpower at 171 exahashes. By May 22, it had fallen to 118 exahashes as miners once again quickly went offline, a 31 percent decline.

Chinese miners hungry for semiconductors

The three big Bitcoin mining rig manufacturers are Bitmain, Canaan, and MicroBT. Bitmain is the largest and most well known, being creator of the iconic Antminer. In a March 10 report by overseas Chinese media Dajiyuan, Bitmain was found to have ties to the CCP, which found Bitmain is connected to the Haidan District Government in Beijing through a “Party Building” alliance and was also granted CCP subsidies and funding.

MicroBT lists its address as Shenzhen and Canaan is headquartered in Beijing and Hangzhou.

Amid a worldwide shortage in semiconductors, both Bitmain and Canaan have sourced the 5nm semiconductors fueling their ASICs from industry leader Taiwan Semiconductor Manufacturing Corporation (TSMC), while MicroBT sources theirs from Samsung.

In March, Taiwanese prosecutors accused Bitmain of setting up front companies and working behind the scenes to poach TSMC staff. According to Nikkei Asia, the scheme rewarded Bitmain with more than 100 engineers.

In a 2017 article by IEEE Explorer focusing on Bitcoin data centers in Inner Mongolia, China, the publication revealed each Antminer S9 used 189 individual chips manufactured by TSMC. The center IEEE visited had more than 20,000 S9s running.

The S9 has since been replaced by the more powerful, and more power-hungry S19 Pro.

The S9 used a 16nm ASIC semiconductor and produced 13.5 terahashes per second with a power consumption of 1320 watts versus the 5nm S19 Pro’s 110 terahashes per second with a power consumption of 3250 watts.

According to Bitcoin mining website MinerDaily, all three manufacturers are sold out of equipment as of May 1. According to 8BTC, the supply shortage has been a problem since at least November of 2020. According to Blockchain.com, BTC’s hash rate nonetheless increased from approximately 130 exahashes in November to its peak in May.

The most expensive lottery in the world

Investing.com says Bitcoin miners were raking in $57 million USD (approximately 365 million Yuan) per day in April when Bitcoin price traded between $47,000 and $65,000 USD.

According to NiceHash, each Antminer S19 Pro, which if available for sale would cost approximately $5,000 USD and can be found in third-party markets at more than double the cost, will generate approximately $22 USD per day at Bitcoin’s current price of $38,000 USD.

According to a 15 cent per kilowatt-hour electricity cost in the State of New York, each 3250- watt machine will make approximately $11 USD per day after paying for electricity. According to some estimates, the cost of power in Inner Mongolia can be as low as 3 cents per kilowatt-hour, which would lead to a profit of more than $20 USD per day.

Because the Bitcoin data centers run 24/7, not to process transactions, but to calculate SHA256 for a chance to win the next block’s lottery, each 3250-watt miner will consume roughly 28,500 kilowatt-hours per year. This figure, however, is only for the mining hardware itself and does not include the cost of HVAC to cool the data center or power for the warehouse itself.

According to the U.S. Energy Information Administration, the average single-family detached home in the south, where air conditioning requirements are the highest, uses slightly less than 16,000 kWh per year.

In a May article by Worldcrunch, which visited cryptocurrency data centers in mainland China, one employee at a rural warehouse was quoted as saying his data center, which mined both Bitcoin and utilized retail video game graphics cards to mine alternative cryptocurrencies such as Etherium, used “the equivalent of the electricity consumption of 10,000 households every day.”

Website Digiconomist calculates Bitcoin’s annual electricity footprint at approximately 121 terawatt-hours, which competes with some countries such as the Netherlands, Pakistan, and Norway.

In an effort to conjure a vision of efficiency for this astronomical sum of Earth’s resource usage, Digiconomist compares Bitcoin to Visa’s data centers. In 2019, Visa used the electricity equivalent of approximately 19,000 U.S. households to process 138 billion transactions. According to an analysis from Blockchain.com, Bitcoin by comparison has processed approximately 112 million transactions year-over-year.

This math breaks down to slightly less than 865,000 Visa transactions being processed for the same energy cost as a single Bitcoin transaction.

For all the energy Bitcoin’s miners spend, the network can still only process approximately five transactions per second because the resources are spent calculating an ever-increasingly difficult encryption algorithm and not on actual transactional load.

In January, CCP-ally Iran suffered rolling power grid failures, which left the capital city Tehran crippled. According to ABC, officials say the culprit was more than 1,600 Bitcoin mining facilities, some legal and others underground, which had overloaded the country’s electric grid capacity. Iran’s electricity cost is roughly 4 cents per kilowatt-hour, according to the report.

In November of 2020, RadioFreeEurope reported the Georgian state of Abkhazia, along with its approximately 250,000 people, suffered the same fate as Iran after Russian mining operations moved in to take advantage of cheap electricity, overloading the country’s grid. The report said some engineers estimated miners were using 120 million kilowatt-hours per month in electricity, or about 10,000 U.S. households.