The founder and Chief Financial Officer of one of the most shocking cases of squandered generational wealth seen in 2021 were arrested and charged in New York after the FBI unsealed a Grand Jury Indictment alleging the pair, along with two other executives, one of which is a former Lehman Brothers trader, had single handedly manipulated the trading patterns of the U.S. stock market.

March of 2021: Archegos caught in Viacom and Discovery crashes

Bill Hwang and his firm, Archegos Capital Management, gained notoriety more than a year ago after the fund lost tens of billions of dollars amid a pump and dump in blue chips such as Viacom and Discovery that saw almost 60 percent of their value erased in a single week.

Hwang and Archegos were caught in a risky leveraged long trade on the stocks—an enormous position amounting to at least $30 billion—with Wall Street behemoths such as Goldman Sachs, Deutsche Bank, Morgan Stanley, and UBS underwriting the part-loan, part-trade.

Archegos’s positions were liquidated by the giants, becoming discounted deals brokered to their clients, when the firm’s position became hopelessly underwater.

Reporting by Wall Street Journal at the time stated that Hwang lost $10 billion in personal wealth alone.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

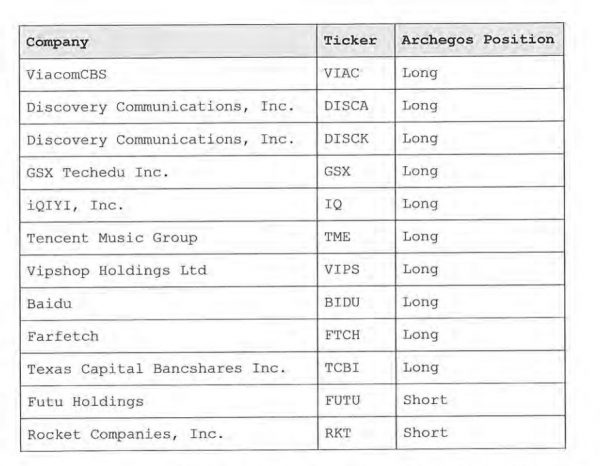

WSJ added that other stocks Archegos and Hwang held were liquidated to Wall Street’s customers—as the firm desperately attempted to deleverage and save its skin—included a number of Chinese tech stocks such as IQIYI, GSX Techedu, Farfetch, Tencent Music, and Baidu.

2021 WALLSTREETBETS GAMESTOP DEBACLE

- Amateur Investors Fodder, Not Driver of GameStop’s Meteoric NYSE Climb

- Robinhood Alternative Webull Hides its China Roots

- Wall Street Behemoths Ate Reddit’s Gamestop Lunch

- Silver Bullion Supply Scarce, Premiums High Amid Wall Street Stockpiling

The Indictment stated that the manipulation was successful in having Hwang beat the market—at least on paper—as Archegos’s holdings in Discovery and Viacom had appreciated more than 250 percent compared to QQQ, the leading Nasdaq-linked index fund, which only appreciated 20 percent over the same time period.

Wall Street connected

Shortly after the destruction of Archegos unfolded, the firm’s website went offline and information about participants became scarce.

However, a January of 2021 web archive capture of the Archegos Leadership page revealed executives had histories not only with some of the biggest names in Wall Street, but also some of the cornerstones of the 2008 financial crisis.

The firm had two Co-Presidents. The first, Brian Jones, was formerly Senior Managing Director at 2008 financial crisis casualty Bear Sterns.

The second, Diana Pae, was a former Managing Director at Goldman Sachs. Prior to that, she worked at JP Morgan, states the capture.

Perhaps most notably, Archegos Head Trader, William Tomita, was a former trader at Lehman Brothers, another keystone of the 2008 crash.

Chief Financial Officer Patrick Halligan was described on the page as “forensic accounting within Arthur Andersen’s fraud investigation team,” in addition to having held management and consulting positions and conducting audit projects with PricewaterhouseCoopers.

Archegos Global Head of Macroeconomic Research Christopher Burn was listed as having formerly worked for the Department of State, Chief Technology Officer Jensen Ko also boasted a former position at Goldman Sachs, and Michael Satine, Chief Compliance Officer, likewise served for “over 30 years in various senior compliance positions” at Goldman Sachs.

Hwang and Halligan charged, Tomita and Becker plead guilty

The April 27 FBI Indictment specifically targeted Bill (Sung Kook) Hwang and CFO Patrick Halligan for their role in the scheme after Head Trader William Tomita and Archegos Director of Risk Management, Scott Becker, pled guilty to charges on April 21.

An FBI press release announcing the charges state that Becker and Tomita are “cooperating with the Government.”

The Indictment states that Hwang faces 11 charges:

- Racketeering Conspiracy – One Count – Maximum 20 years imprisonment

- Securities Fraud – Two Counts – Maximum 20 years imprisonment on each count

- Market Manipulation – Seven Counts – Maximum 20 years imprisonment on each count

- Wire Fraud – One Count – Maximum 20 years imprisonment

Puppet Masters

The FBI alleges that Hwang and Tomita joined forces to single handedly perform the task of “manipulating, controlling, and artificially affecting the market for certain securities in Archegos’s portfolio.”

Hwang, the Indictment states, led the market to believe that the exponential price increases seen at the time were “the product of natural forces of supply and demand.”

Instead, the FBI alleges, “In truth, they were the product of HWANG’s manipulative trading and deceptive conduct that caused others to trade.”

Get rich quick

The FBI’s Indictment claims that between March of 2020 and the end of March 2021, Hwang had increased his personal fortune exponentially from $1.5 billion to $35 billion.

However, the devil is in the details. The Indictment also alleges that Hwang. Tomita, Halligan, and Becker worked together to deceive the Wall Street behemoths financing their March of 2021 positions—which the FBI states were “larger than any of the disclosed shareholders of multiple public companies”—which ballooned to the tune of a stunning $160 billion.

For perspective, Elon Musk’s takeover of Twitter is a $44 billion transaction, of which the Tesla founder is only posting $21 billion directly.

Bloomberg reports that to complete the transaction, $12.5 billion was obtained in a loan using Tesla shares as collateral, while $13 billion in debt financing.

House of cards

The FBI alleges that when Archegos’s gargatuan bets began to unwind, Wall Street began declining to provide additional financing to keep the firm solvent.

Archegos did not want to exit its positions and realize material losses, so instead the firm’s traders, under Hwang’s direction, began a vain attempt to keep their own market afloat by buying more.

Over the course of a few days, Archegos exhausted its remaining cash and credit supplies, buying billions of dollars in extra stock.

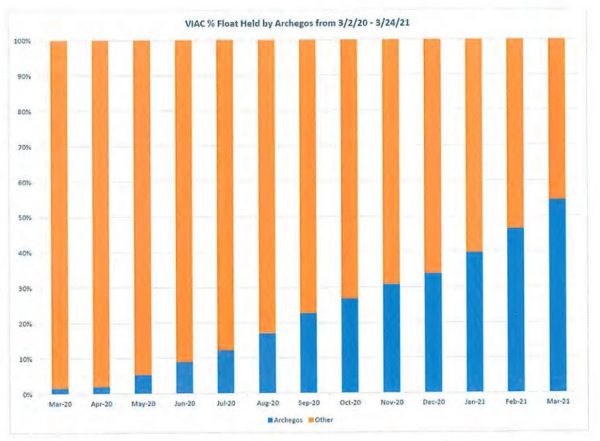

In some cases, Archegos effectively owned as much as 50 percent of a company’s float at one time.

Like a whirlpool

The FBI Indictment noted that Archegos used a strategy wherein they would purchase billions of dollars of certain stocks, such as ViacomCBS, through normal and legitimate means until they began to approach the 5 percent holdings limit where the firm would be required to publicly disclose themselves as a major shareholder.

In order to buy more while flying under regulatory radar, keeping the public and other traders in the dark, Archegos utilized its leveraging and financing arrangements with the Wall Street banks to trade by way of a “total return swap.”

A total return swap is effectively just entities such as Goldman Sachs and UBS Group providing leverage in exchange for collateral and a fee, but with the banks hedging their risk by also purchasing “baskets” of the same stock, so that as their client’s trade succeeded it was hedged by their own successes.

The result is that Archegos’s manipulations, the FBI alleges, brought major players into the same market, resulting in even the banks becoming the major shareholders of the now-bubbling and highly risky securities.

Additionally, the Indictment notes that major holders of some of the securities Archegos dabbled were index funds, the significance of which is that those funds would not sell their positions, regardless of market performance.

For such funds, this means they bore the risk, but not the reward, of an artificial pump and the liquidation-induced dump that followed.

The market maker

The FBI alleges that Hwang and Tomita served as the de facto market maker of the securities they held positions in.

In one example in the case of Discovery, during a five month period from November of 2020 to March of 2021, Archegos often personally amounted to 20 percent of the market’s daily trading volume, a figure that rose to as high as 30 or 35 percent.

Hwang and Tomita also amounted to between 10 and 25 percent of all daily trading volume in ViacomCBS between October of 2020 and March of 2021.

Additionally, the Indictment alleges that Archegos would put enormous multi-million dollar limit buy orders in at certain prices starting at the opening bell, continually raising the order throughout the day to force prices higher into market close.

Defrauding Wall Street

The Indictment also alleges that Wall Street banks have clean hands, having conducted due diligence on Hwang and Archegos before extending the leverage required to produce the total return swap arrangement.

Additionally, the contracts contained certain caveats, such as concentration of holdings, open position size, and a varying margin interest rate for the purposes of controlling the firms’ risk exposure.

However, the FBI states that Halligan, Tomita, and Becker, at Hwang’s direction, provided “false, deceptive, and misleading” documentation for the purpose of obtaining more credit to sustain the cash flow needed to support their market making activities.

Specifically, the principals lied to Wall Street about how liquid their positions were, the composition of the company’s portfolio, and how concentrated holdings in the major companies were, the Indictment alleges.

Furthermore, when the ceiling began coming down on Archegos and Hwang, the firm began to lie to its masters about how much cash it had remaining and its overall financial position in an attempt to maintain, and even secure additional credit.

Not the first rodeo

Notably in 2012, Hwang pled guilty to wire fraud charges in connection with a scheme perpetrated by Archegos Capital Management’s predecessor, Tiger Asia, involving insider trading of Chinese bank stocks.

Reporting from WSJ at the time stated that Hwang and Tiger Asia agreed to pay $16 million in addition to $44 million to settle a “separate, but related civil lawsuit” filed by the SEC in New Jersey.