EDITOR'S PICK

-

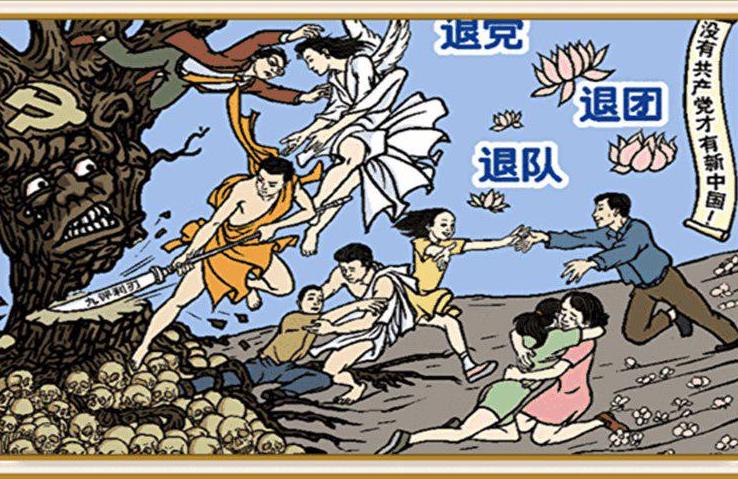

‘The CCP is the greatest enemy of the Chinese nation’: Statements From the Tuidang Movement (March 2024)

-

Master Li Hongzhi: How Humankind Came to Be

‘China has been poisoned for over a century’: Statements From the Tuidang Movement (April 2024)

Latest

- Tibetans Who Sold Their Homes to Chinese Buyers Say Compensation Was Too Low

- Uyghur Butcher Freed After Seven Years Behind Bars for Discouraging Alcohol and Smoking

- Arizona Rancher George Alan Kelly Will Not Be Retried for Death of Mexican Migrant

- ‘It moved my spirit’: See Why Theatergoers Are Enchanted With Shen Yun

- Blinken in China: Calls for ‘Level Playing Field,’ Resolution Over Trade Disputes

FEATURED

-

‘The CCP Does Not Represent China’: Falun Gong Practitioners Commemorate 25th Anniversary of Appeal in Beijing

-

US Considering Sanctions on Chinese Banks for Russia Dealings, But No Concrete Plans Yet

-

Biden Proposes Tripling Tariffs on Chinese Steel, Aluminum to Counter Beijing’s Product Dumping

-

US Puts Pressure on China as Ukraine War Escalates

-

Communist China Heads Down a Road of Isolation and Impoverishment

-

Chinese-American Artists Targeted in Planned NYT Piece That Would Misrepresent Falun Gong, Shen Yun Performing Arts

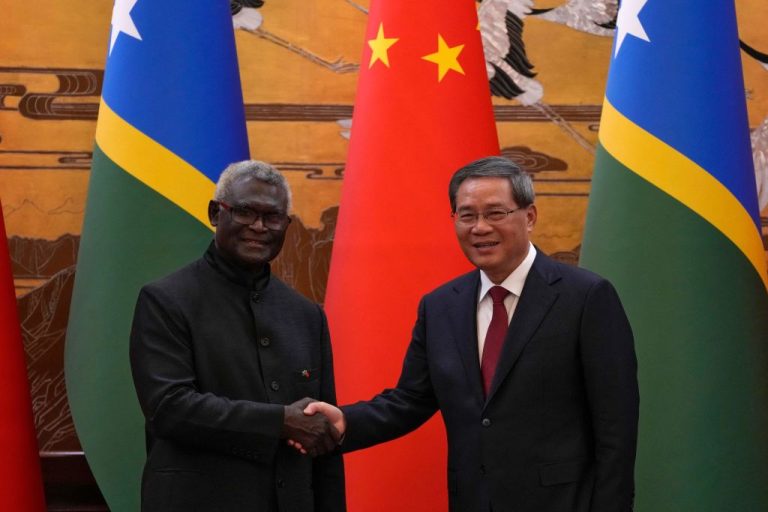

Pro-CCP Sogavare Steps Down as Leader of the Solomons, Dealing Major Blow to Beijing

Lifestyle

-

Baoding Balls – They Do Much Better Than Bounce

-

For Powerful Traditional Remedies, Know and Grow Medicinal Herbs (G) Geranium

Understanding Gut Feelings: Should We Trust Them?

A popular saying advises us to “trust our gut.” Where do gut feelings come from and how reliable are they as decision-making tools?

POLICY & POLITICS

In an attempt to retain seasoned officers, a group of 28 New York State lawmakers lobbied Albany to provide a boost to officer’s pensions in the recently signed $237 billion budget bill. Officers who now stick around for at least 25 years will be eligible for an annual pension worth

-

Innovation, Sustainability Shine at Natural Products Expo in California

ANAHEIM, California — The Natural Products Expo West stands out as a

-

Boeing Whistleblower Says Company’s Entire Fleet ‘Needs Attention’ Recommends All 787 Dreamliner Planes Be Grounded

On April 16, Sam Salehpour, a Boeing engineer turned whistleblower, told NBC

-

Hundreds of Migrants Descend on New York City Hall Pleading for Work Permits, Green Cards

On April 16, hundreds of migrants — many believed to be illegal

- US to Continue Sanctioning Iran to Disrupt its ‘Malign and Destabilizing Activity,’ Yellen Says

- ‘Extraordinary artistry’: Shen Yun Delights Theatergoers in Sold-Out Lincoln Center Shows

- ‘Very Positive Trends’: Number of Homicides Drops Significantly in the Big Apple

- US and Japan Forge Deeper Alliance to Counter China, Strengthen Economic Ties

- Controversial Geoengineering Experiment Launched Quietly in San Francisco to Avoid Public Backlash

- NY: Long Island Sen. Mario Mattera Tables Bill Addressing Squatting ‘Epidemic’

- Culinary Brilliance on Display at 87 Sussex: Jersey City’s New Dining Gem

- ‘An extension of their souls’: Shen Yun Continues to Wow at Lincoln Center

- ‘Beautiful!’: Shen Yun Wows Audiences in Multiple Sold Out Lincoln Center Performances

The current government of Taiwan announced a drive to remove 760 statues of Chiang Kai-shek, the military leader who ruled the Republic of China (ROC) on the mainland and then Taiwan from the mid-1920s until his death in 1975. Chiang's legacy is a matter of deep controversy in modern Taiwan,

-

Over 110,000 Ordered to Evacuate as Guangdong Reels From Catastrophic Floods

In recent days, the southern Chinese province of Guangdong has become the focal point of a severe environmental

-

China’s Overseas Product Dumping: Addressing Unfair Competition Caused by Systemic Differences

By Dr. Chen Po-chih The recent surge in low-priced exports of electric vehicles (EVs) from China has raised

Published with permission from LuxuryWeb Magazine Nestled in the base of the Atlas Mountains, Marrakech is a historic city that encapsulates the essence of Morocco. It boasts the largest and oldest medina in the nation, a UNESCO World Heritage Site. Navigating through the narrow, serpentine alleys of Marrakech’s ancient quarter,

-

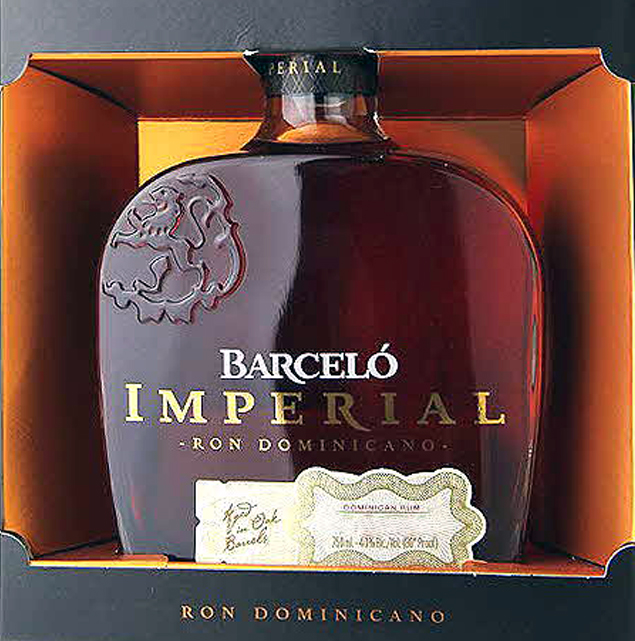

Caribbean Treasure: Discovering the Rich Heritage of Ron Barceló Imperial Rum

Published with permission from LuxuryWeb Magazine Originating from the Caribbean island of

-

Charges Laid One Year After Historic Canadian Gold Heist

On April 17, at a news conference, Canada’s Peel Regional Police said

-

A Journey Through Morocco: How to Master the Region’s Delicious Culinary Traditions

Published with permission from LuxuryWeb Magazine Moroccan culinary arts are steeped in

- South Korea’s President Yoon and Ruling Party Suffer Legislative Election Loss in Setback for Anti-Communist Politics

- TikTok Surges in Vietnam Despite Increased Regulatory Pressures

- Civil War in Sudan Enters 2nd Year: 15,000 Dead, 8 Million Displaced

- Peter Pellegrini Wins Slovak Presidential Election, Beating Pro-Western Opposition

- White House Directs NASA to Create Time Standard for the Moon

- Chinese Students Recount Horrifying Experience During Concert Hall Shooting in Moscow

- Japan Reverses Course, Increases Interest Rates for First Time in 17 Years

- Davide Scabin Rumored to Bring Culinary Genius Back to Turin, Italy

- Hong Kong Passes Infamous ‘Article 23’ in Show of Growing Communist Hold

While people have been enjoying sweets for thousands of years, the concept of dessert has gradually evolved from simple and refreshing, to the complex explosion of decadence we are tempted with today. In many areas, desserts are a treasured cultural tradition – defined by signature ingredients, loving preparation and sweet

-

The Fascinating Process Behind the Beauty of Natural Fibers (Part VIII): Pineapple

In our exploration of natural fibers we again return to South America to visit another dual-purpose crop. Believe it or not, the same plant that produces sweet and exotic pineapples, offers an equally-exotic fiber valued for both its beauty and durability. This short-lived perennial is cultivated in many tropical areas

In our exploration of natural fibers we again return to South America to visit another dual-purpose crop. Believe it or not, the same plant that produces sweet and exotic pineapples, offers an equally-exotic fiber valued for both its beauty and durability. This short-lived perennial is cultivated in many tropical areas

-

Honoring Tradition: How Hong Kong’s ‘Noonday Gun’ Echoes Through History

Published with permission from LuxuryWeb Magazine Every day at noon in Hong Kong, a distinct ceremony unfolds —

-

Nature’s Mystery: The Egg-Laying Cliff on Gandang Mountain in China

Can cliffs lay eggs? That is what the cliff at the base of Mount Gandang in China's Guizhou

Do you suffer chronic symptoms that can’t be pinned down to any specific cause? Gastrointestinal disorders, headaches, hives, congestion, and itchy eyes can all be caused by histamine intolerance. Like gluten intolerance a couple decades ago, this condition is just gaining recognition and becoming a topic of study. Because it

-

For Powerful Traditional Remedies, Know and Grow Medicinal Herbs (F) Feverfew

Sprightly and tenacious, feverfew is a member of the world’s largest and most diverse plant family — Asteraceae.

-

The Power of Optimism – The Key to Longevity and Health

Life is hard, and staying positive is even harder. There are those who, despite sporting the scars of

Recent research has surfaced suggesting a major change in the themes of Mandarin song lyrics — particularly those performed by and aimed at Chinese women. Where love and romance were once common, now there seems to be a call for freedom. According to a team led by Wenbo Wang, business

-

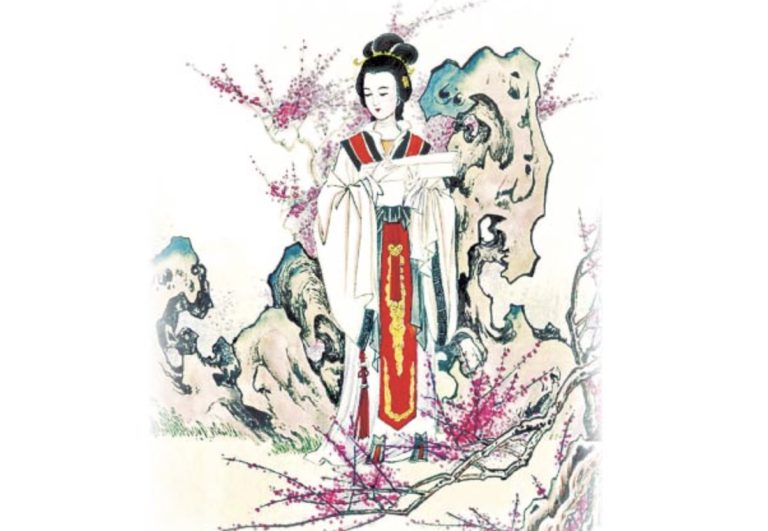

5 Exemplary Women of Ancient China

In ancient China, women were educated and raised to uphold a range of traditional values, which could be

-

‘A new breath of life’: Shen Yun’s Opening Night at Lincoln Center Met With Resounding Acclaim

NEW YORK, New York — On April 3, Shen Yun kicked off its highly anticipated 14-show run at