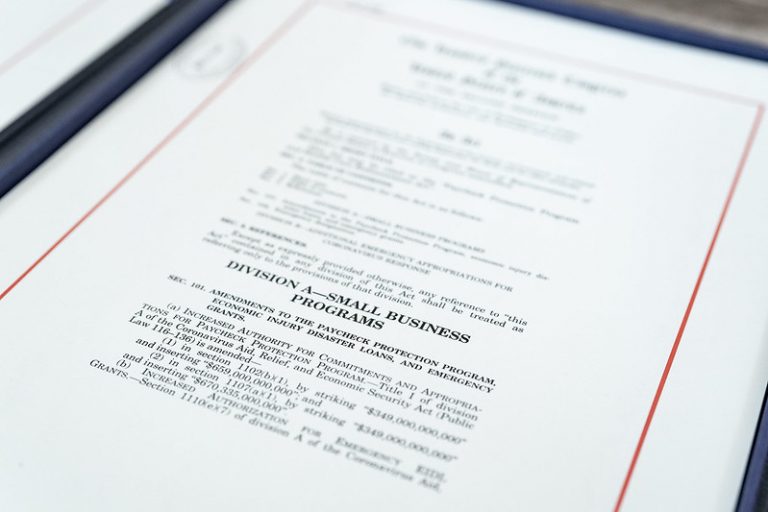

In 2020, the Trump administration set up a business loan scheme called the Paycheck Protection Program (PPP) under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to help small businesses negatively impacted by the Coronavirus Disease 2019 (COVID-19) pandemic. Entities were given loans with low interest rates to help pay employee wages and cover other expenses.

Unfortunately, several companies owned and funded by the Chinese Communist Party (CCP) took advantage of the program, including an online real estate company named Fundrise headquartered in Washington. The company, founded in 2010, is said to be the first firm to successfully crowdfund investments in the real estate market.

In 2014, Chinese social networking company Renren invested 31 million dollars in the first round of Series A investments in Fundrise. Renren is a NYSE-listed company headquartered in Beijing. During the early stages of the pandemic, Fundrise was forced to cut its marketing spending by 80 percent, reduce senior management salaries by 20 percent, and freeze hiring efforts.

Fundrise then applied for and received funds under the PPP program. “After seeing a decrease in new customer growth and revenue in March and April, we were extremely fortunate to receive an SBA Paycheck Protection Program (PPP) loan, which we’ve put 100% towards the salaries of our employees,” the company website states.

Fundrise has 150,000 active investors, 5.1 billion dollars in total asset transaction values, and has disbursed 100 million dollars in net dividends to investors. The company has been listed in the Forbes Fintech 50 list three times and recognized as a top workplace by the Washington Post.

CCP-backed beneficiaries

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

Like Fundrise, several dozens of Chinese companies have received loans through the PPP program. According to a report by Horizon Advisory, over 125 companies, which were owned or had investments from Chinese entities, received money under the PPP.

The 125 companies are estimated to have received anywhere between 192 to 419 million dollars in loans. A minimum of 32 companies owned by Chinese entities received more than 1 million dollars each, with loans totaling around 85 to 180 million dollars.

Some of these companies have ties to the Chinese military and were involved in the government’s genocide campaign against Uyghurs. Eight entities are affiliated with Chinese defense conglomerates identified by the U.S. Defense Department as having ties to the People’s Liberation Army (PLA).

“The identified recipients linked to PRC-based ownership span critical and strategic industries including aerospace and defense; pharmaceuticals and medical technology; legacy and emerging automotive manufacturing; advanced manufacturing and manufacturing components (e.g., semiconductors, robotics); telecommunications; financial technology; entertainment; and media,” according to the report.

Around 22 companies were from the biopharmaceutical and medical technology industries, 24 were from the automotive industry, and 28 were from the information technology industry. Some noteworthy recipients include:

- Aviage Systems, which received around $150,000 to $350,000, and Continental Aerospace Technologies Inc., which received 5 to 10 million dollars. Both are owned by the CCP-backed Aviation Industry Corp of China (AVIC), which was classified by the U.S. Department of Defense (DoD) as a Chinese military company in June 2020.

- HNA Training Center NY and HNA Group North America LLC, both of which received around $350,000 to 1 million dollars. They are subsidiaries of a Fortune Global 500 company called HNA Group, which is involved in several sectors including financial services, aviation, and real estate. HNA Group is a part of Beijing’s military-civilian fusion program. In 2019, an HNA subsidiary signed a Military-Civilian Fusion Strategic Framework Agreement with Lingyun Technology Group Co., Ltd in Wuhan.

- BGI Americas Corporation, which received $350,000 to 1 million dollars. It is a subsidiary of Chinese gene-testing global giant BGI, which has deep ties with the communist regime. The company is reportedly helping the government to build a gene bank in Xinjiang, a region where the Uyghur community is being persecuted by the CCP. Following media reports of BGI Americas receiving PPP funding, the company decided to return the loans.

- CloudMinds Technology Inc. received 1 to 2 million dollars from the PPP program. The California-based company is backed by China’s Keystone Ventures. Several CloudMinds entities were placed on a “debarred list” by the U.S. Department of Commerce in 2020 due to their involvement in activities deemed to be against American interests and national security.