A multi-billion dollar relief plan, intended to support businesses in the U.S. grappling with the fallout of the COVID-19 pandemic, has turned into a multi-billion dollar disaster with prosecutors now saying that billions of dollars of taxpayer’s money has been lost to fraudsters and is likely unrecoverable.

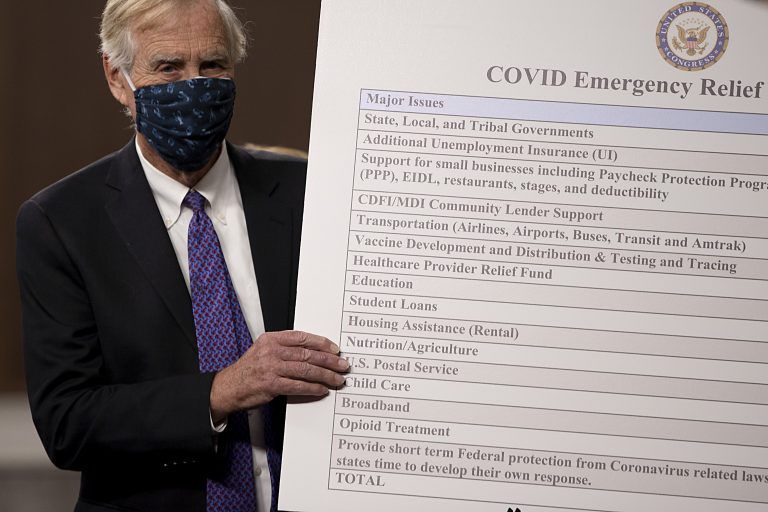

The Paycheck Protection Program (PPP), is a $953-billion business loan program established in 2020 through the Coronavirus Aid, Relief and Economic Security Act (CARES Act) that was intended to assist businesses, self-employed workers, sole proprietors and other businesses to continue to pay their employees and fund their enterprises amid strict lockdowns and uncertainty brought on by the pandemic.

The program however has been wrought with fraud leaving the American taxpayer holding the bill.

The numbers are staggering. Experts are saying that roughly $80 billion has been siphoned from the PPP in addition to $400 billion believed to have been stolen from the $900 billion COVID-19 unemployment relief program.

While the prevalence of COVID-19 relief fraud has been known for some time, the massive scope of the fraud and the implications are just now being digested and no one appears to know just how much was defrauded.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

Matthew Schneider, a former U.S. attorney from Michigan told NBC News, “Nothing like this has ever happened before. It is the biggest fraud in a generation.”

How the fraudsters did it

In conversation with NBC Nightly News, Justice Department General Michael Horowitz, who oversaw COVID-19 relief spending, said that Covid relief programs were structured in ways that made them ripe for plunder.

“The Small Business Administration, in sending that money out, basically said to people, ‘Apply and sign and tell us that you’re really entitled to the money,’” Horowitz said, adding that, “And of course, for fraudsters, that’s an invitation … What didn’t happen was even minimal checks to make sure that the money was getting to the right people at the right time.”

The fraud was carried out by both individual criminals and organized crime groups using stolen identities with each stolen identity worth upwards of $30,000 a piece.

Government backed loans, that were forgivable if the companies spent the funds on business expenses, were issued to millions of entities; some 10 million of these loans have already been forgiven, according to NBC News.

Experts now say that millions of borrowers inflated the number of employees they employed or created entire companies from scratch in order to access as much of the relief as possible.

Lenders, perhaps because they were disbursing money other than their own, did very little to verify applications in the interest of getting the money out fast. Lenders were also guaranteed that they would be “held harmless for borrowers’ failure to comply with program criteria.”

When the program was first unveiled, the Government Accountability Office warned of the risk of fraud but its warnings fell on deaf ears.

Haywood Talcove, the CEO for government at LexisNexis Risk Solutions, which works with the U.S. government to verify identities, said that the basic scheme was “really simple.”

Fraudsters would go on state websites and use the names of existing businesses or newly registered fake ones. “There’s absolutely no security on there. There’s no validation of any information. And voila, you have company ABC with 40 employees and a payroll of $10 million. And you go and apply for a PPP loan. It was a piece of cake,” Talcove told NBC News.

The situation is so dire that the U.S. government launched the Pandemic Accountability Committee that is employing data scientists who use artificial intelligence to sift through 150 million records in an attempt to identify fraud patterns. “In one case it found that a phone number for a gas station in Houston was used on 150 loan applications,” NBC News reported.

A Florida man, David Hines, 29, admitted to a fraud scheme that garnered him $3.9 million, according to court documents.

Hines reportedly bought a $318,000 Lamborghini Huracán and also spent thousands on luxury hotels, jewelry, clothing, and dating sites. In this case, much of the funds were recovered.

Another case involved a man and woman from Miami, who claimed they were operating farms, with numerous employees, out of a single family home located in the middle of Miami.

Juan Gonzalez, U.S. attorney for the Southern District of Florida, said, “Once you looked at the paperwork and once you saw what it was, all it took was a drive to the farm to see there was no farm.” The “farmers” received 18 and 30 months in prison for their crimes.

In yet another case from Florida, another couple was convicted last June of defrauding the program of $18 million. The perpetrators used the funds to purchase three homes, diamonds, gold coins, luxury watches, expensive furniture and other valuables. When it came time for them to be sentenced, they cut off their ankle bracelets and fled, abandoning their children, according to the FBI.

They were subsequently captured the following February in Montenegro. The man received 17 years in prison and his wife got six.

Dismal level of prosecutions

To date, only 178 people have been convicted in PPP fraud cases, according to the Justice Department. However, despite “many more prosecutions coming” only a small fraction of the fraudsters are expected to be held to account.

“Even if the numbers reach 2,000 – or 20,000 – it will be only a small fraction of the fraud,” NBC News reported.

The massive fraud occurred primarily due to how the government chose to disburse the funds. Gonzalez said, “You have government releasing a lot of money as quickly as possible into the hands of people who really need it. As usually happens, the faster the money needs to go out, the less likely there are to be the appropriate checks in place to make sure that people who don’t deserve that money don’t get it.”

What surprised Gonzalez was just how “blatant” the fraud was. “How individuals would just go ahead and lie on these applications – get the money and then go ahead and just openly spend it … thinking that they’re going to do that without anybody checking up on it.”

“Some fraud is inevitable. That’s the price that the government was willing to pay to get the money as quickly as possible into the hands of those that really needed it,” Gonzalez added.

Larry Kudlow, once a top economic adviser to President Donald Trump, when the program was first proposed said, “I explained to him that this was going to be the biggest fraud in the history of our country. And then I was told that you can have speed or you can have security. And that they’d rather just get the money out.”