Since late March, the Chinese Communist Party (CCP) has faced potential risks to its semiconductor industry as COVID-19 and political tensions with the West threaten its capabilities.

Despite the lockdowns and political repercussions, China’s top chipmakers are eager to move forward and continue expanding their operations. This is especially true as Washington’s own efforts to hinder the CCP’s progress have also hit certain roadblocks.

Shanghai lockdown

One primary roadblock for China’s semiconductor supply chain is the lockdown imposed on Friday, Mar. 26 on the town of Zhangjiang, known as Shanghai’s Silicon Valley.

READ MORE:

- 26 Million People Under Shanghai Lockdown as Chinese Regime Deploys Strictest COVID Measures Since Pandemic Began

- China Deploys Special COVID Task Force to Shanghai as Cases Skyrocket

- People in Shenzhen Jump Off Buildings in Protest of Prolonged Lockdowns Under China’s ‘Zero-COVID’ Measures

The effects of this lockdown were exacerbated due to the fall of semiconductor imports by 1.2 percent in the first two months of 2021 during a global chip shortage.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

Following other industrial areas like Shenzhen, Zhangjiang’s authority extended its already-existing lockdown and began mass testing last week.

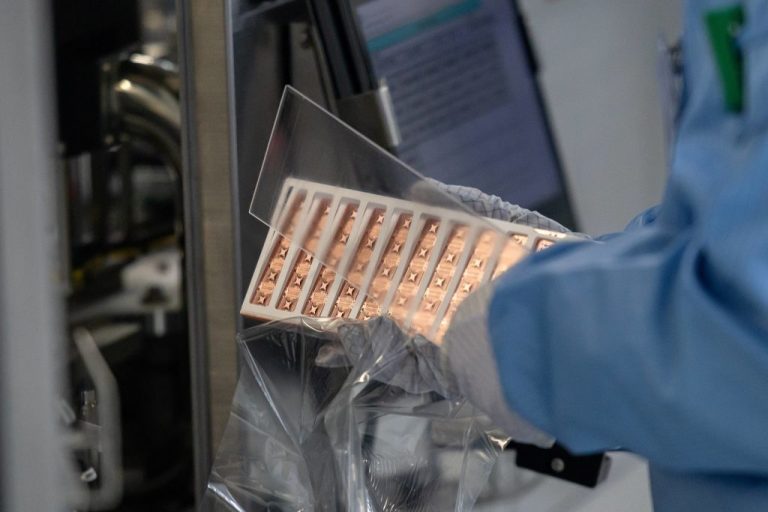

The hi-tech region hosts several factories and offices of semiconductor firms, which were not required to lockdown. However, the surrounding residential areas were locked down.

Hua Hong Semiconductors and Semiconductor Manufacturing International Corp (SMIC) were among the fully-operating companies. The latter told the South China Morning Post (SCMP) that it worked on its prevention measures and production remains operational.

Several areas are still closed down, forcing workers to work from home.

Shanghai resident Zhang Xiaonan told SCMP that while her father’s company inside the park was shut down, the factories in the same area continued to operate. Xie Ruifeng, a senior analyst at semiconductor firm ICwise, said that most production facilities, or fabs, would not lock down easily due to their contributions to production.

If Shanghai imposes a full lockdown on Zhangjiang, it could heavily affect “the semiconductor manufacturing and packaging value chain,” leading to delays in logistics.

U.S. proposes ‘chip alliance’

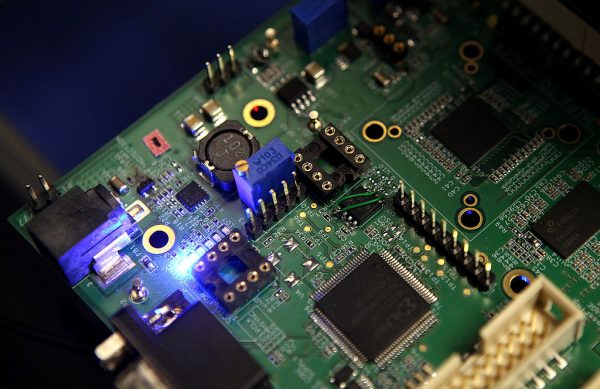

On Wednesday, Mar. 30, the U.S. proposed a “chip alliance” with several nations, including Japan, South Korea, and Taiwan.

The proposal reportedly came after the Biden administration pushed for a $52 billion chip bill to fund its domestic semiconductor manufacturing and research.

Washington has been hoping to reduce its supply chain reliance on communist China during the global chip shortage. European Union (EU) officials also pondered the idea of uniting “like-minded” democracies together to move away from China’s supply chain.

Seoul has rejected the proposal for such a cooperative effort, fearing that Beijing would “retaliate” against its companies like Samsung and SK Hynix. Both companies have benefited from China’s chip facilities.

The idea of excluding China from the semiconductor alliance has earned Washington the ire of Chinese social media. Some say that the decision would only encourage Beijing to increase its efforts to enhance its technology. Others think that the chip alliance would be impossible given China’s overwhelming market control over chip companies in Taiwan and South Korea.

Both Samsung and SK Hynix are currently operating in China, which could be affected if Seoul agreed to such an alliance.

Washington has also warned Beijing that it will hit local firms should the CCP send semiconductors to Russia, which has been hit with numerous international sanctions due to its conflict with Ukraine, U.S. Commerce Secretary Gina Raimondo said on Wednesday, Mar. 23.

Beijing moves on

As the U.S. and the pandemic pressure Beijing, the communist government’s semiconductor firms claim that they will continue to “push ahead” with plans to expand their capacities, especially since there has been a “surge in demand” for more chips.

READ MORE:

- Consumer Electronics Demand Down ‘Especially in China’ Says TSMC Chief

- Taiwan Should Destroy its Semiconductor Industry if Beijing Invades: US Study

- US Welcomes $12 Billion Investment by Taiwan Semiconductor Firm

SMIC’s revenue reached 35.6 billion yuan ($5.6 billion) in 2021. Its net profits soared to 10.7 billion yuan ($1.68 billion), an almost 147 percent increase in 2021 alone. Hua Hong Semiconductor’s revenue in 2021 reached $1.63 billion, up 70 percent from the previous year.

SMIC is also “keeping a low profile” since it was excluded from Washington’s warnings to Beijing not to work with Russia. The firm’s revenues from Eurasia, including Russia, are about 12 percent, according to data from the fourth quarter of 2021.

Beijing-based phone brand Xiaomi is the most prominent in Russia, beating out Apple and Samsung with a 31 percent market share.