EDITOR'S PICK

-

‘China has been poisoned for over a century’: Statements From the Tuidang Movement (April 2024)

-

‘The CCP is the greatest enemy of the Chinese nation’: Statements From the Tuidang Movement (March 2024)

Why Millions of People Celebrate May 13 as World Falun Dafa Day

Latest

- Biking to Work Can Boost Your Mental Health: Cycling Study

- Northern Lights Producing Solar Storm Continues to Light Up the Sky For Millions

- OpenAI Reveals GPT-4o Featuring New Voice, Text and Visual Capabilities

- Italy Tries to Ease Fears Over Curbs on Costly Constructions Incentives

- US Discusses China’s Repatriation of North Koreans, Expresses Concerns

FEATURED

-

Destruction of Ancestral Temple in Southern China Brings 4,000 People Out in Protest

-

EU Leaders Meet Xi Jinping in Paris, Express Concern Over Beijing’s Trade Practices

-

How the CCP Inflates China’s GDP

-

Pro-CCP Sogavare Steps Down as Leader of the Solomons, Dealing Major Blow to Beijing

-

‘The CCP Does Not Represent China’: Falun Gong Practitioners Commemorate 25th Anniversary of Appeal in Beijing

-

US Considering Sanctions on Chinese Banks for Russia Dealings, But No Concrete Plans Yet

Biden Approves Hefty Tariff Hike on Chinese Imports, Sparking Economic Debate

Japan's top steelmaker, Nippon Steel, is sticking to its plan to close a deal by year-end to buy U.S. Steel, which it expects to boost output and profits, the company said on May 9, despite resistance to the transaction in the United States. In December, Nippon Steel offered nearly $15

-

‘Undermines our integrity’: Kenneth Chiu Describes Allegations of Voter Fraud in NYS Assembly Race

FLUSHING, New York — On May 8, Kenneth Chiu, a candidate for

-

Jose Perez: A Culinary Visionary Transforming American Dining

Jose Perez, an unassuming entrepreneur with a passion for flavor, has quietly

-

TikTok Sues to Overturn US Law Forcing Divestment From ByteDance

In the latest chapter of ongoing tensions between TikTok and the U.S.

- NY: Dozens of Jewish Sites Receive Disturbing Bomb Threat Text

- How NYC’s Business Improvement Districts Are Helping Small Businesses Thrive

- NY: This Broadway Hotel Has Been Quietly Operating as a Migrant Shelter for Over a Year

- Thousands Arrested as Student Protests Spread, Grow Violent

- Meet Kenneth Paek: Veteran, Policeman, and Advocate Vying for NY’s 25th Assembly

- Oil Prices Set for Steepest Weekly Drop in Three Months

- In China, Blinken Lays Out America’s Red Lines on Russia, Other Tensions

- Arizona Rancher George Alan Kelly Will Not Be Retried for Death of Mexican Migrant

- American Taxpayers Paying $451 Billion Annually to Address Southern Border Crisis

On May 8 (Wednesday), Hong Kong's Court of Appeal banned the song “Glory to Hong Kong” — popular in the city as a protest anthem — following a request filed by the city’s government. The ruling overturned a lower court judgment that had rejected the ban in light of the

-

CCP Sends Planes Over Median Line to Taiwan, Practices Landing Drills

On Friday, May 3, a new incursion of Communist Chinese military aircraft was detected by the Taiwan Defense

-

Chinese Coast Guard Ships Damaged Philippine Vessels With Water Cannons, Officials Say

Tensions continue to rise in the South China Sea, after on Wednesday (May 2) a Philippine official accused

Published with permission from LuxuryWeb Magazine Democracy, as practiced today, is modeled after the ancient Athenian prototype, wherein all citizens participated in deciding their rulers by majority vote. But this model currently embodies only the aspect that favors the affluent and powerful, neglecting the essential counterpart: ostracism. In ancient Athens,

-

Russia Detains Two US Citizens, Including American Soldier

On May 7 (Tuesday), Russian authorities said they had detained two U.S.

-

India’s Modi Aims for Supermajority in Upcoming General Election

As India goes through its six-week long trail to the general election,

-

Spain Ends Traditional Bullfighting Award Amid Cultural Shift, Animal Advocacy

Published with permission from LuxuryWeb Magazine In a landmark decision, Spain's Culture

- Russia Starts Drills With Tactical Nuclear Weapons in Response to ‘Provocative Statements’ From West

- Australia’s Defense Minister Denounces China Over Aerial Confrontation

- Flooding in Southern Brazil Claims at Least 39 Lives After Torrential Rains

- Pandeli Locandasi: A Culinary Beacon Above Istanbul’s Vibrant Spice Bazaar

- ‘It moved my spirit’: See Why Theatergoers Are Enchanted With Shen Yun

- Blinken in China: Calls for ‘Level Playing Field,’ Resolution Over Trade Disputes

- Moroccan Charm: A Timeless Journey Through Marrakech’s Ancient Medinas

- Taiwan to Remove Statues of Nationalist Chinese Leader Chiang Kai-shek

- Biden Signs Law Granting Massive $95 Billion Foreign Aid Package, Passes TikTok Bill

Nestled between the Catskill Mountains and the Adirondacks in New York State, the Mohawk Valley area boasts a rare gemstone. Herkimer diamonds can be found within exposed outcrops of dolomite formed some 500 million years ago. They are named after Herkimer County, New York, one of precious few places on

-

Understanding Gut Feelings: Should We Trust Them?

We have all experienced so called "gut feelings" – when we suddenly feel uneasy about something that rationally seems fine or, conversely, have firm confidence in something that has a high risk of failure. These puzzling flashes of insight are also referred to as intuition, hunches or sixth sense. They

We have all experienced so called "gut feelings" – when we suddenly feel uneasy about something that rationally seems fine or, conversely, have firm confidence in something that has a high risk of failure. These puzzling flashes of insight are also referred to as intuition, hunches or sixth sense. They

-

Baoding Balls – They Do Much Better Than Bounce

Baoding balls may have been invented in China’s city of the same name, located in Hebei Province, but

-

Innovation, Sustainability Shine at Natural Products Expo in California

ANAHEIM, California — The Natural Products Expo West stands out as a premier trade show within the natural,

Geraniums are among the long list of baffling botanical nomenclature. While the beautiful showy flowers that are purchased each summer to dress up the garden (and may or may not be brought in over the winter) are widely known as geraniums; they are, botanically speaking, actually Pelargoniums. This genus does

-

A Holistic Approach to Histamine Intolerance

Do you suffer chronic symptoms that can’t be pinned down to any specific cause? Gastrointestinal disorders, headaches, hives,

-

For Powerful Traditional Remedies, Know and Grow Medicinal Herbs (F) Feverfew

Sprightly and tenacious, feverfew is a member of the world’s largest and most diverse plant family — Asteraceae.

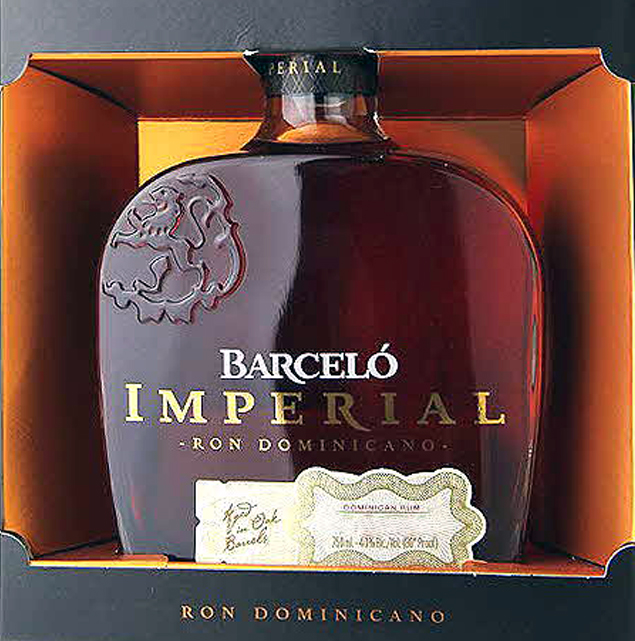

Published with permission from LuxuryWeb Magazine Originating from the Caribbean island of Hispaniola, once a stronghold of some of the most infamous pirates — Henry Morgan, Blackbeard, Anne Bonny, Calico Jack, and Bartholomew Roberts — Ron Barceló Imperial Rum embodies a treasure that any 16th or 17th-century privateer would have

-

Mandarin Pop Song Lyrics Shift From Romance to Calls for Freedom, New Research Suggests

Recent research has surfaced suggesting a major change in the themes of Mandarin song lyrics — particularly those

-

A Journey Through Morocco: How to Master the Region’s Delicious Culinary Traditions

Published with permission from LuxuryWeb Magazine Moroccan culinary arts are steeped in a rich history that spans thousands