Analysis

LONDON (Reuters) — With the mystery of the blasts that destroyed undersea gas pipelines between Russia and Germany unsolved, Nord Stream 1’s insurers and reinsurers are grappling with how to respond to hundreds of millions of dollars in potential claims.

Munich Re and syndicates within the Lloyd’s of London market are among the major underwriters for Nord Stream 1, four industry sources with knowledge of the situation said, adding that it was unclear whether they would renew its cover.

If the insurance is not renewed, the prospect of the pipeline bringing gas to Europe under the Baltic Sea ever being repaired and restarted becomes more remote.

Even before leaks were found, supplies via Nord Stream 1 had been halted as a result of a dispute over Western sanctions on Russia, while the newly-built Nord Stream 2 pipeline had not started commercial deliveries.

Success

You are now signed up for our newsletter

Success

Check your email to complete sign up

While a claim has not yet been made for the damage and disruption to the pipeline, two of the sources told Reuters, Nord Stream 1’s underwriters may dispute any submitted on the grounds that the damage was an act of self-sabotage, or of war, neither of which are generally covered by insurance.

Amid speculation as to who was behind alleged sabotage that severed the pipelines at the centre of an energy crisis prompted by Russia’s invasion of Ukraine, Danish police said on Oct. 18 that the damage to Nord Stream 1 was caused by powerful blasts.

While damage itself would not necessarily affect the renewal of a property policy, insurers might ask for more premium, said Tim Shepherd, a litigation partner at Mayer Brown.

For the underwriters of the pipeline system, which Nord Stream’s website says was built with 7.8 billion euros (USD$7.6 billion) of investment, the stakes are high.

Reuters was not able to identify all of its underwriters, but another of the sources said Swiss insurer Zurich also had exposure to Nord Stream 1.

Munich Re, Zurich and Lloyd’s all declined to comment.

“Even if you are taking a small size (of cover), it is a big risk,” one of the four industry sources said.

“The issue is going to be what happens if you can’t prove it is a state sponsor (responsible for the blasts), you end up with a massive claim for damage,” the source added.

Nord Stream 1’s majority shareholder with a 51 percent stake is a subsidiary of Russian energy group Gazprom, which is subject to sanctions by the United States, Britain and Canada as well as some European Union restrictions.

Two of the sources said renewal of Nord Stream 1 cover by the Lloyd’s syndicates would be challenging given the risk of tighter sanctions on Gazprom, which would prevent paying claims.

German energy groups Wintershall and E.ON, meanwhile, hold 15.5 percent each. Wintershall did not immediately respond to a request for comment.

An E.ON spokesperson said Nord Stream 1’s operating company was responsible for operational issues, including insurance.

“Nord Stream AG remains in close contact with relevant authorities about the recent incident. Due to prevailing uncertainties, we as a shareholder continuously monitor developments and are in close contact with the other relevant stakeholders,” the spokesperson said.

Gazprom and Swiss-based Nord Stream AG, did not respond to requests for comment, while French energy provider ENGIE, which has a 9 percent stake, declined to comment.

Dutch natural gas infrastructure company N.V. Nederlandse Gasunie, which also has a 9 percent stake, said it would assess the situation as soon as there was more clarity.

“The exact extent of the damage and possible follow-up actions can only be determined after inspection of the pipelines and that is not yet possible at this moment,” Gasunie said.

“We are in close contact with our European partners and the relevant government authorities,” it added.

A ‘Deliberate act’?

Nord Stream’s insurers will have to prove that its policy does not cover the damage caused by the blasts in order to avoid paying out on any claim, lawyers said.

Although property policies typically exclude malicious damage, policy holders often buy extra cover, which is likely in Nord Stream’s case, legal and insurance sources said.

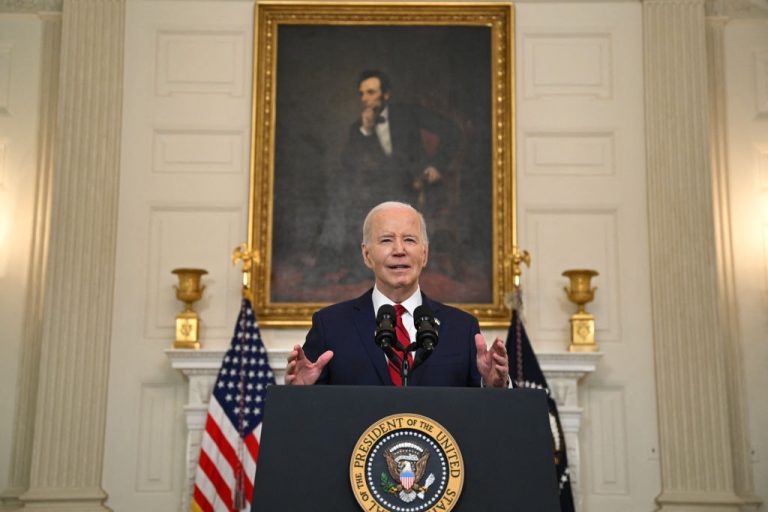

Russian President Vladimir Putin has said the United States and its allies blew up the pipelines, an allegation that has been dismissed by the White House. U.S. President Joe Biden has said damage to Nord Stream was a deliberate act of sabotage.

The West has not directly pointed the finger at Moscow, which has denied any involvement.

French President Emmanuel Macron said earlier this month that Nordic leaders had told their European partners it was still impossible to say at this stage who was behind the damage.

If a Western state actor was found to be responsible, the damage might be designated as an act of terror, which one broking source said might be covered by insurance.

However, if investigations found Russia to have been involved, insurers could argue it was an act of “self-sabotage”, given Gazprom is owned by the state.

“If there was a deliberate act by the policyholder, you are not going to have a covered claim,” said David Pryce, managing partner at Fenchurch Law, which is not involved with the policy.

If there was any Russian involvement it could also mean the Nord Stream 1 damage being designated as an act of war, something that is typically excluded by insurance policies.

By Reuters. (Additional reporting by Christoph Steitz and Tom Sims in Frankfurt, Vladimir Soldatkin in Moscow, Toby Sterling in Amsterdam and Benjamin Mallet in Paris and Alexander Huebner in Munich; Editing by Rachel Armstrong and Alexander Smith)